Sublime

An inspiration engine for ideas

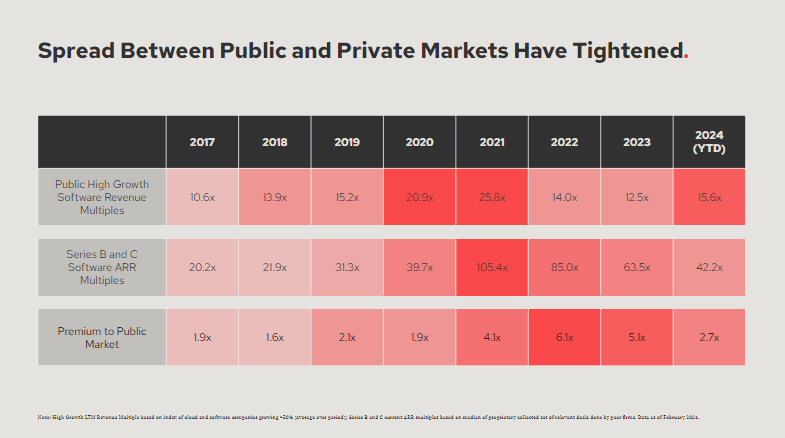

This month, Redpoint Ventures published an interesting report on the state of US SaaS investing:

For someone like me sitting in India - the US market still has an impact on our market (publics & private) - so I decided to read it; sharing ~3 key takeaways:

(1) Software sales quotas are more... See more

Risks to the trend

- LPs too slow to react, VCs lack incentives to admit limitations in current processes

- Poor quant performance

- Downturn in private markets

Katelyn Donnelly • Quant comes to Venture Capital

I’m 2 years removed from market neutral but someone sent me Morgan Stanley factors today and this is absolute death. https://t.co/sH5lXlUsUA

Hosted 20 GPs for dinner yesterday. A few main takeaways from the conversation:

1) Despite the efficiency AI brings, it will not be cheaper to scale a company. Dollar spend will be different, but heightened competition will require $ still (AWS replacing server needs did NOT reduce capital... See more

samir kajix.com

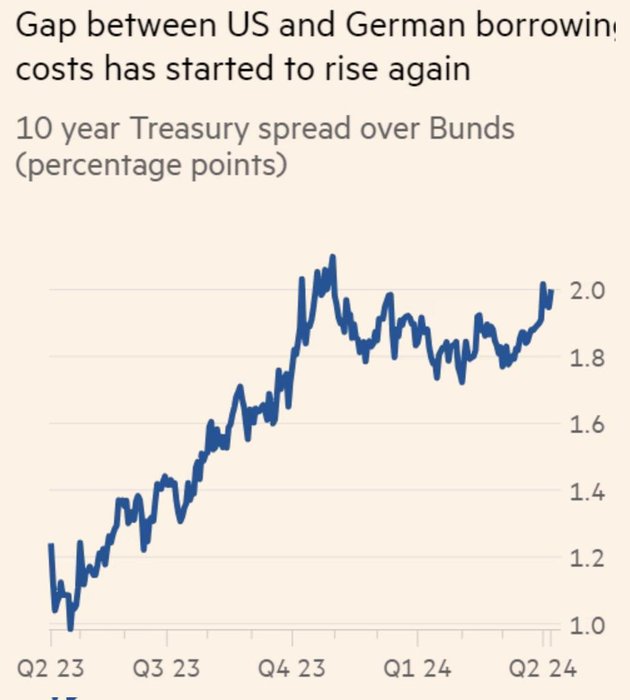

Mega bond investors are buying Eurozone bonds in preference to US Treasuries. Why? Because they expect the ECB to be able to cut rates earlier than the inflation-constrained Fed. UST-Bund spread is thus widening (right). More evidence that Fed rate cuts aren't baked in yet.

1/2 https://t.co/pVNKCKmZ3Z

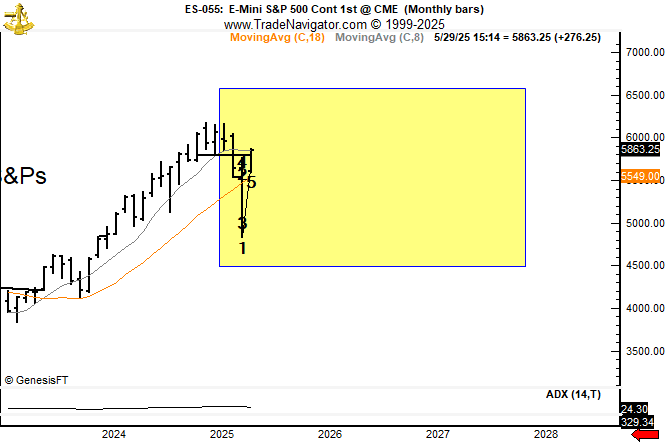

It has been my position for some time that the S&Ps have entered a multi-year pattern of +20%/-20% on either side of 5,500. I am committed in company pension account to high quality dividend stocks. I currently have no stock index futures positions in the company's trading account.

Time will tell