Strategy

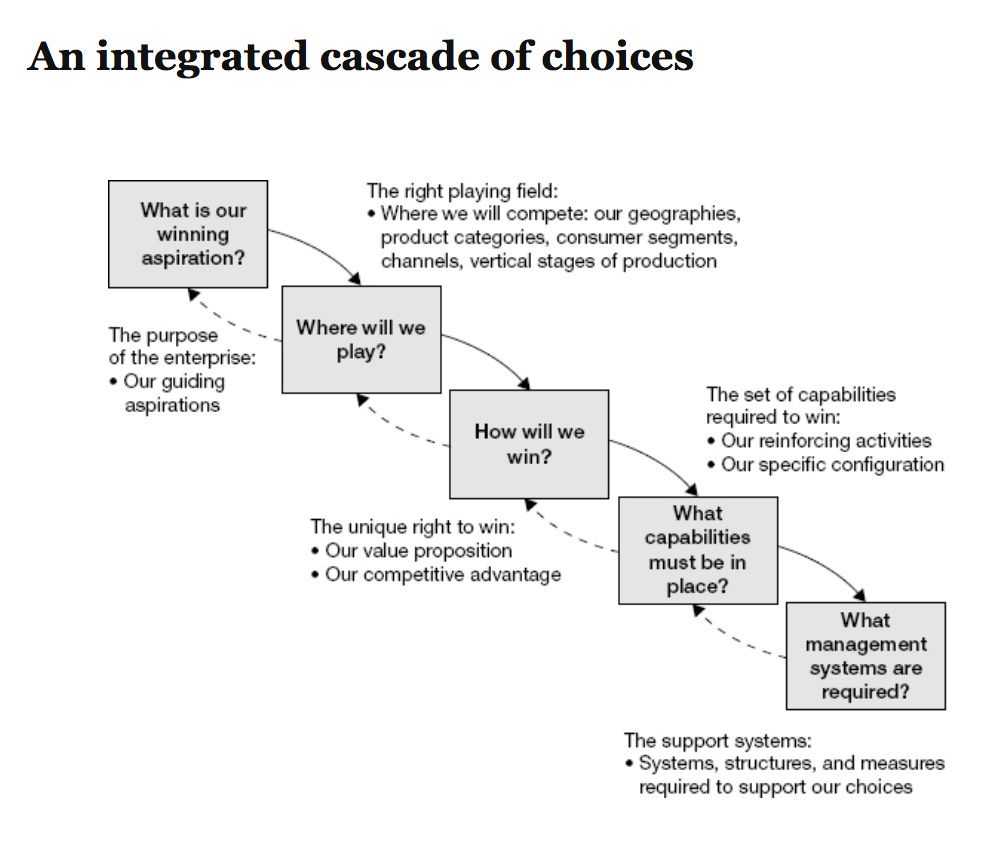

Answering key questions about:

• Potential growth markets

• High-demand product types

• Attractive consumer segments

• Natural channel choices

Our team of experts can help shape your company’s winning strategy, ensuring success and growth in the competitive market by implementing a well-crafted competitive strategy.

Stephen M. Walker II • Playing to Win: The Must-Read Book for Developing Winning Business Strategy

How Asset-Backed Financing (aka Securitization) Works

The simplest way to understand an asset-backed facility is that it’s like a credit card that you can buy one thing with.

Packy McCormick • Capital Intensity Isn't Bad

During the Amortization Period, the music stops. No more new assets. All cash flows from existing assets go straight to paying down investor principal. This is usually triggered by time or performance metrics falling below certain thresholds. Putting a deal into an amortization phase more quickly is a risk mitigation feature that can help limit

... See morePacky McCormick • Capital Intensity Isn't Bad

Capital Velocity : Your equity dollar "turns" faster - instead of being locked in one robot, it can support the deployment of multiple robots over time.

Leverage Effect : Each equity dollar leverages debt capital (the AB facility) to deploy more total assets than equity alone could support.

Continuous Deployment : Capital recycling enables

Packy McCormick • Capital Intensity Isn't Bad

The opportunity lost by increasing the amount of blank space is gained back with enhanced attention on what remains. More white space means that less information is presented. In turn, proportionately more attention shall be paid to that which is made less available. When there is less, we appreciate everything much more.

John Maeda • The Laws of Simplicity (Simplicity: Design, Technology, Business, Life)

A unique activity that does not contribute to the firm’s value and cost drivers makes no strategic contribution.