Tapering IS Quantitative Tightening

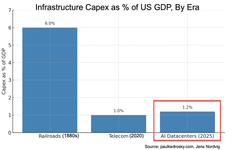

Honey, AI Capex is Eating the Economy

paulkedrosky.com

Various factors can trigger reversal: a medium’s overuse, overextension, ubiquity, reaching the limits of its potential, or excessive ease of use leading to excessive intrusiveness. What they all have in common is the reaching of extremes or limits in any characteristic of use.

Andrey Mir • The Digital Reversal. Thread-saga of Media Evolution

QE (quantitative easing) operations essentially involve asset swaps. The Fed balance sheet expands by the Fed buying securities in the open market and simultaneously injecting liquidity as payment. Balance sheets still balance, but the Fed’s balance sheet has grown larger and the private sector’s balance sheet has changed its composition and,... See more