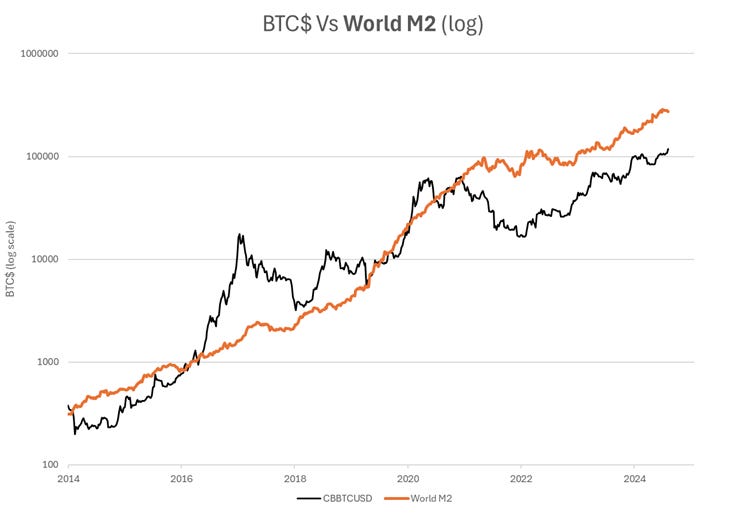

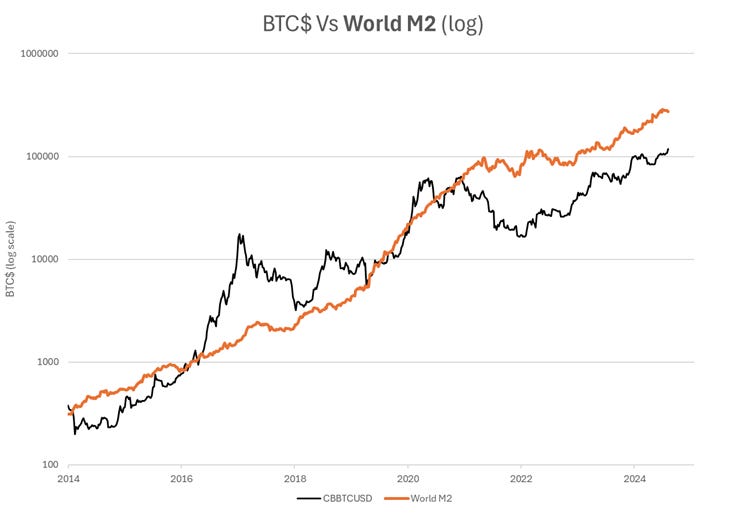

Looking ahead, the US is likely to see lower policy rates (circa 3%) and increased liquidity stimulus despite near-term inflation risks, as supply-side shocks from higher tariffs (taxes) slow growth and eventually curb price pressures. The Fed and Treasury are employing unconventional tools – including ‘Not-QE, QE’ (backdoor liquidity injections),... See more