Sublime

An inspiration engine for ideas

Venture Building

Sarah Wong • 5 cards

David Clark responded to my tweet that median fund size for fund returners was $350M and many funds >$1b also

google.com • Inbox (6,480) - tyler.faught92@gmail.com - Gmail

Arpan Shah

@arpanshah

Andy W

@aweissman

Startups

Paul Sturrock • 10 cards

we're investing $30M over the next 30 days 🚀

I'll be co-hosting our new program kicking off in San Francisco, starting January 2025, alongside folks from the a16z SPEEDRUN team -- with speakers, personalized coaching, and a bunch of funding!

Applications now open. Deadline at end of month,... See more

andrew chenx.com

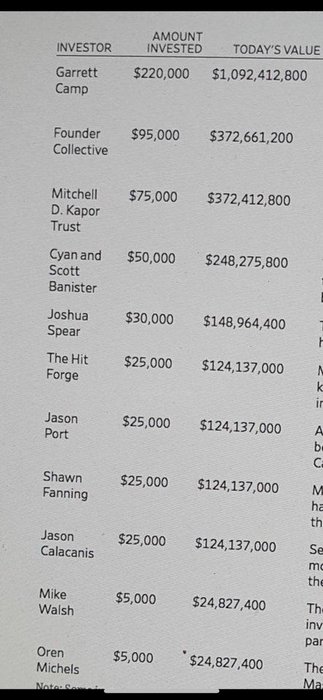

For those of you who thinking of making small seed investments... Even $5k @joinrepublic or @AngelList investments could be life changing... Early Uber investors... https://t.co/EMjGnXxcOh