Sublime

An inspiration engine for ideas

Basically, there are four factors that create irrational market behavior: overconfidence, biased judgments, herd mentality, and loss aversion.

Burton G. Malkiel • A Random Walk Down Wall Street: The Best Investment Guide That Money Can Buy (Thirteenth)

Later I found out that Markowitz himself knew the same thing: Ironically, when he invested the money from his Nobel Prize, he used a portfolio with equal weights to pick a few of his favorite stocks rather than the formula he received the prize for discovering.

J. Doyne Farmer • Making Sense of Chaos: A Better Economics for a Better World

Weigh second- and third-order consequences.

Ray Dalio • Principles: Life and Work

Thaler empezó a llevar una lista en la que anotaba muchas cosas irracionales que hacen las personas y que los economistas afirman que no hacen, porque los economistas creen que la gente es racional.

Michael Lewis • Deshaciendo errores: Kahneman, Tversky y la amistad que nos enseñó cómo funciona la mente (Spanish Edition)

rate. In other words, the utility of the first $100 you win or earn is greater than your utility from the next incremental $100.

Hermann Simon • Confessions of the Pricing Man: How Price Affects Everything

many people love lotteries. Some governments are already using this insight.

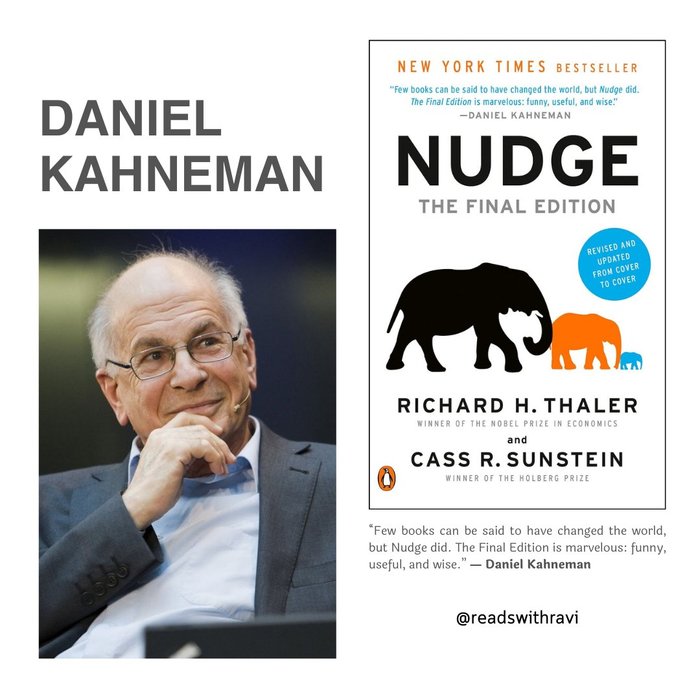

Richard H. Thaler • Nudge: The Final Edition

Much of the time, more money can made by catering to human frailties than by helping people to avoid them.

Richard H. Thaler • Nudge: The Final Edition

Classical economists have probably never left their laboratories and lecture halls to venture into the real world. Most people playing the Ultimatum Game reject very low offers because they are ‘unfair’. They prefer losing a dollar to looking like suckers. Since this is how the real world functions, few people make very low offers in the first

... See more