Sublime

An inspiration engine for ideas

A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing (Tenth Edition)

amazon.com

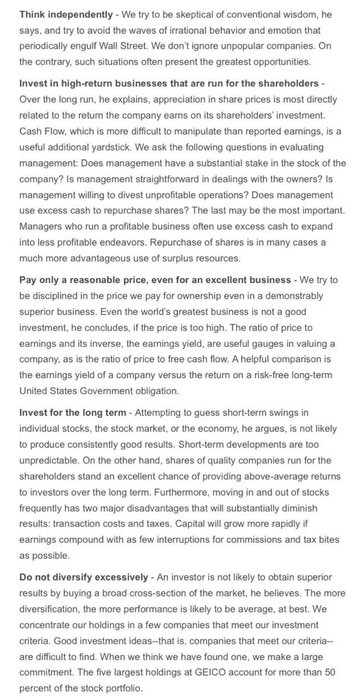

Louis Simpson was able to average a 20% annual gain over the 24yrs he was in charge of GEICO’s $4 billion portfolio.

In this Washington Post interview he laid down his investment philosophy https://t.co/6urwYgOXU1

providing advice and transaction services to the more complex but (we hoped) more durable and profitable business of investing.

Stephen A. Schwarzman • What It Takes

The investors we examine, however, tend to be variance seekers. At the same time, however, they are able to produce returns with low downside volatility compared to the underlying markets in which they invest.

Allen C. Benello • Concentrated Investing: Strategies of the World's Greatest Concentrated Value Investors

Investing

Nishal Desai • 4 cards

Finally, another common approach is to back into the required fund value to guarantee a Net LP return multiple (i.e. net of fees and carry). For e.g. for a $100M fund to return 3x net to its LPs given the standard 2 and 20 model and $850K in total fund expenses, the total net return for the fund would have to be $370M after taking into account the ... See more

Kauffman Fellows • Venture Fund Portfolio Construction | Journal | Kauffman Fellows

Yale calls its hedge fund strategy “absolute return,” meaning that it is investing in this asset class largely to generate high long-term returns by exploiting market inefficiencies with relatively low correlation to broader equity

Scott Kupor • Secrets of Sand Hill Road

Over the next thirty years, I would expect an equal-weighted portfolio of Berkshire Hathaway $BRK.B, Costco $COST, and Daily Journal $DJCO to outperform the S&P 500. Munger's legacy will roll on.

The Conservative Income Investorx.com