Nishal Desai

@nnd

Nishal Desai

@nnd

Future of Work and Short Form Ideas

wrote about this in my Substack a while ago

But yes, it’s just you have to build the right skills to do the tasks rather than try to fit into a role

Studying how algorithms influence identity, this can be programmed

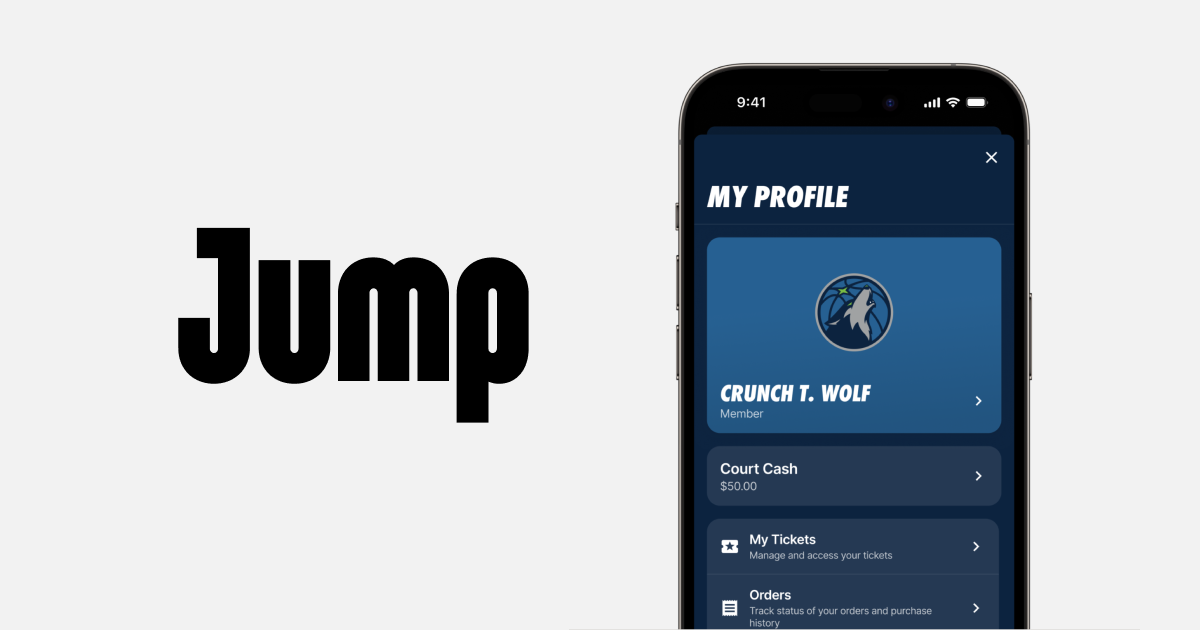

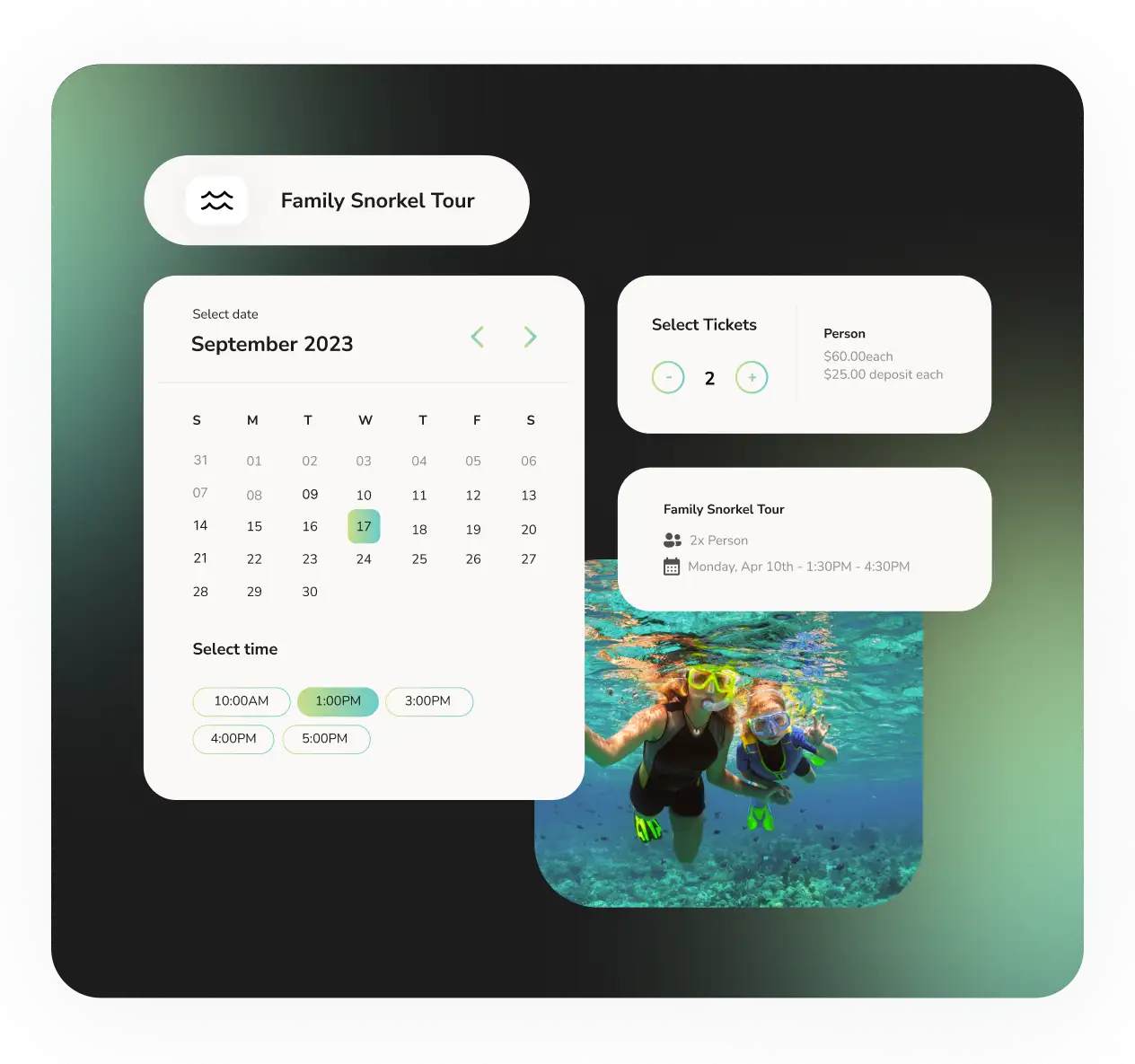

More demand for better and seamless live experiences. Bridging physical and digital.