Sublime

An inspiration engine for ideas

925 Ideas to Help You Save Money, Get Out of Debt and Retire A Millionaire So You Can Leave Your Mark on the World

amazon.com

But first, we’ll set up automatic credit card payments so you never miss a payment again. Then, we’ll see how to cut fees, get better rewards, and take everything you can from the credit card companies.

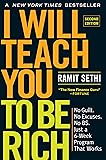

Ramit Sethi • I Will Teach You to Be Rich, Second Edition: No Guilt. No Excuses. No BS. Just a 6-Week Program That Works

Call your credit card companies, and ask them to lower your interest rates, or transfer balances to lower interest cards. Always return items that you don’t need or want. Don’t allow yourself to keep something you won’t use, just because it’s inconvenient or uncomfortable to get your money back.

Nancy Levin • Worthy: Boost Your Self-Worth to Grow Your Net Worth

Most credit card reps you talk to will simply give in because they know you came to play in the big leagues.

Ramit Sethi • I Will Teach You to Be Rich, Second Edition: No Guilt. No Excuses. No BS. Just a 6-Week Program That Works

Mitchel mastered Rule Four by taking a hiatus from his aggressive debt payments and putting that money toward his thirty-day buffer. His spending was still tight, but knowing it was for the purpose of building his buffer made the penny-pinching more tolerable.

Jesse Mecham • You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want

In principle, any person can spend any amount of money, provided he has sought the necessary advice before making the decision; the larger the purchase, the more people are typically involved in the advice process.