Sublime

An inspiration engine for ideas

The important conclusion from this research is that an algorithm that is constructed on the back of an envelope is often good enough to compete with an optimally weighted formula, and certainly good enough to outdo expert judgment. This logic can be applied in many domains, ranging from the selection of stocks by portfolio managers to the choices

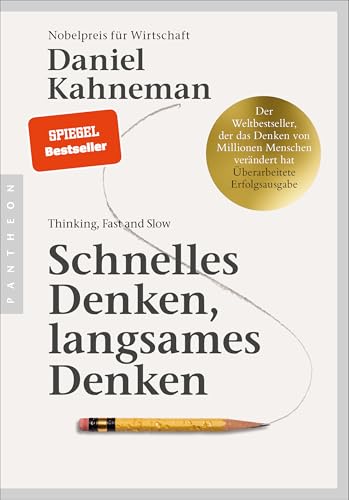

... See moreDaniel Kahneman • Thinking, Fast and Slow

We were mainly concerned with differences between gambles with high or low probability of winning.

Daniel Kahneman • Thinking, Fast and Slow

“Prospect Theory: An Analysis of Decision Under Risk,” a theory of choice that is by some counts more influential than our work on judgment, and is one of the foundations of behavioral economics.

Daniel Kahneman • Thinking, Fast and Slow

They called it the “Fallacy of Conjunction.” With this experiment, and a host of others, Kahneman and Tversky exposed a sort of tic in our mental machinery: we’re deeply affected by vivid, available evidence, to such a degree that we’re willing to make judgments that violate simple logic. We over-conclude based on the available information. We have

... See moreRhiannon Beaubien • The Great Mental Models Volume 1: General Thinking Concepts

En 2009, Kahneman et Klein ont, ce qui n’est pas commun, coécrit un article dans lequel ils ont confronté leurs points de vue, pas pour le plaisir de la confrontation, mais pour trouver un terrain d’entente. Et ils l’ont trouvé. Ils sont tombés d’accord sur un point : l’expérience permet aux spécialistes de s’améliorer, mais seulement dans certains

... See moreDavid Epstein • Range : Le règne des généralistes : Pourquoi ils triomphent dans un monde de spécialistes (Business) (French Edition)

Nobel Prize winner Daniel Kahneman indicates that on average, we are twice as loss-averse compared to seeking a gain209

Yu-kai Chou • Actionable Gamification: Beyond Points, Badges, and Leaderboards

Man, he wrote, has two systems of thought: System 1, our animal mind, is fast, instinctive, and emotional; System 2 is slow, deliberative, and logical. And System 1 is far more influential. In fact, it guides and steers our rational thoughts.

Chris Voss • Never Split the Difference: Negotiating as if Your Life Depended on It