State of the Arts

Gen AI for music has captured ~$300M in funding so far this year across several high-profile deals, the majority of which either focus on rights management and attribution (Musical AI, Vermillio, BRIA AI) or emphasize B2B partnerships (Music AI, ElevenLabs).

This suggests that industry alignment, rather than disruption, is the thesis that investors

Source: Water & Music, H1 2025: THE YEAR SO FAR IN MUSIC TECH DEALS

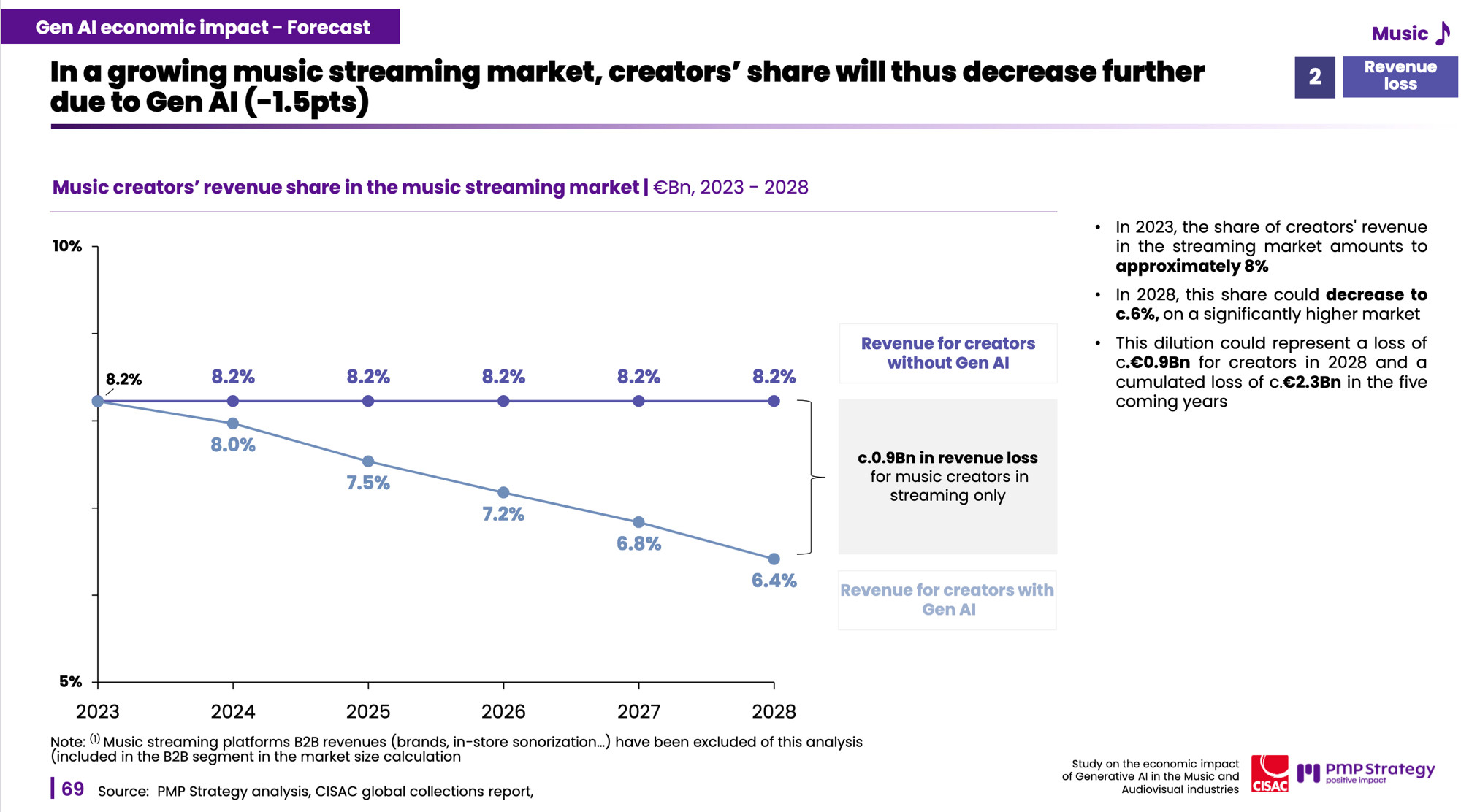

“Today musicians only keep 8% of streaming revenues, but AI will squeeze them further. Four years from now, musicians will only receive 6.4% of streaming revenues (Source: CISAC).” | Source

Hellman & Friedman 's majority stake in Global Music Rights marks a watershed moment — private equity firms now control three major PROs (alongside New Mountain Capital's BMI and Blackstone's SESAC). Blackstone 's successful acquisition of Hipgnosis Songs Fund further cements institutional investors’ central role in the financialization of music... See more

Music tech ownership ouroboros, 2025 edition

The major labels are finally facing a crucial reality: Independent music's market share keeps climbing, and controlling the infrastructure behind it is becoming as vital as owning rights.

Universal Music Group's Virgin Music Group led this charge in 2024 — snapping up Downtown Music Holdings in a $775M power move (pending regulatory approval), as... See more

Universal Music Group's Virgin Music Group led this charge in 2024 — snapping up Downtown Music Holdings in a $775M power move (pending regulatory approval), as... See more

Music tech ownership ouroboros, 2025 edition

Music has emerged as private equity's recession-resistant darling, thanks to streaming's predictable revenue patterns and live entertainment's remarkable post-pandemic resilience.

Music tech ownership ouroboros, 2025 edition

What isn’t discussed as much — but is happening in parallel with equal if not greater force, is the shift in corporate music-industry power dynamics away from the Western hemisphere, and towards Asia and the Middle East.

More specifically, music-industry capital flows are now inseparable from both Chinese and Saudi money . While these markets may... See more

More specifically, music-industry capital flows are now inseparable from both Chinese and Saudi money . While these markets may... See more

Bow down to our new music-tech overlords

Major music rights holders and tech companies are now expected to generate profits for a dizzying array of stakeholders sitting outside of industry borders, including banks, private equity firms, big-tech conglomerates, and sovereign wealth funds — not to mention public retail investors.

There has been no central resource tracking these macro shifts... See more

There has been no central resource tracking these macro shifts... See more

Bow down to our new music-tech overlords

In a stunning rebuke of traditional GOP deregulatory instincts, the Senate voted 99–1 to kill the measure. For the first time in decades, conservative priorities placed local cultural guardianship over the absolute freedom to innovate. That vote showed just how unsteady the old coalitions have become, and how powerful the populist realignment... See more

If the Tech Right sees this fight as the inevitable march of progress, the Populist Right is writing an entirely different anthem. Nowhere is this more visible than in Tennessee, where Governor Bill Lee signed the ELVIS Act, a landmark law recognizing an artist’s voice and likeness as a protected property right, specifically to block unauthorized... See more