right brain > left brain

Mimetic Hauntology

Big Data Can be Bad Data (Michael E. Smith): Putting math in it does not make it science if the numbers were made

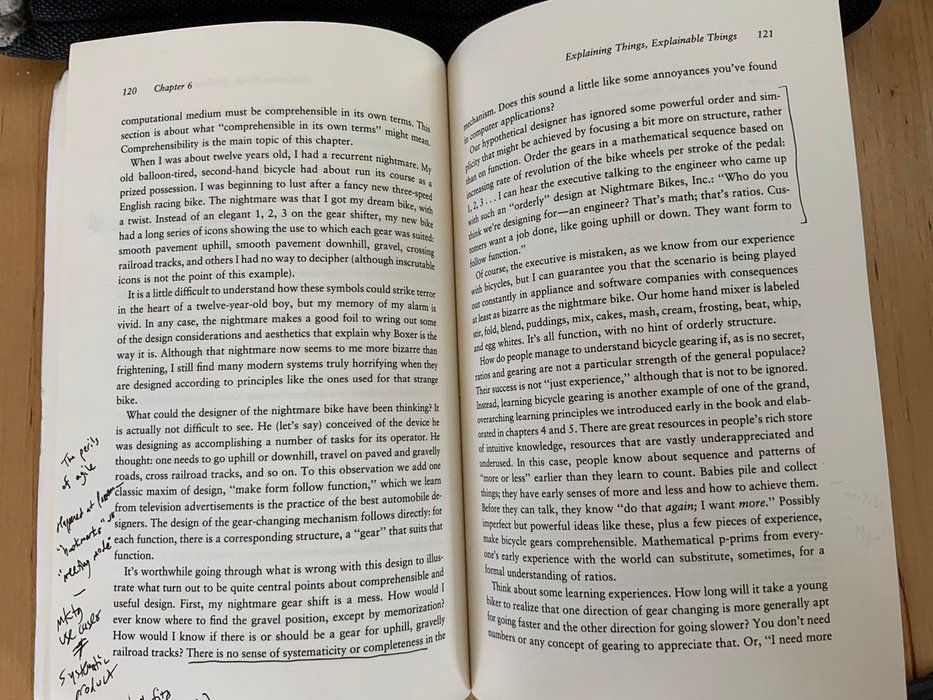

Sean • Knowing Things Is Hard

So true and so much data is bad data or is cherry picked.

Nick is seeing himself in that story right now in 2008 he's like I got I got Berkshire I got Amazon the key is

to not mess that up he the key is to not interrupt this these honest compounding machines which in itself is a decision a daily decision not to do anything and arguably more difficult than to do something because I think we are naturally

... See moreFounders Podcast • #365 Nick Sleep's Letters: The Full Collection of the Nomad Investment Partnership Letters

Is this me today with Lemonade, Hims and Aduro?

Welcome to New Possibilities

although we are all interested in margin it must never be done at the expense of our philosophy margin must be obtained by

better buying emphasis on selling the right kinds of goods we want to sell operating efficiencies lower Mark markdowns greater turnover increasing the retail prices and justifying on the basis that we are still competitive could

... See moreFounders Podcast • #365 Nick Sleep's Letters: The Full Collection of the Nomad Investment Partnership Letters

Sol Price memo from 1967 with Nick Sleep commentary

Research Incumbency Rule: “Once an article is published in some approved venue, it is taken as truth. Criticisms which would absolutely derail a submission in pre-publication review can be brushed aside if they are presented after publication. This is what you call ‘the burden of proof on critics.'”

Sean • Knowing Things Is Hard