https://t.co/NeizgBIfIC

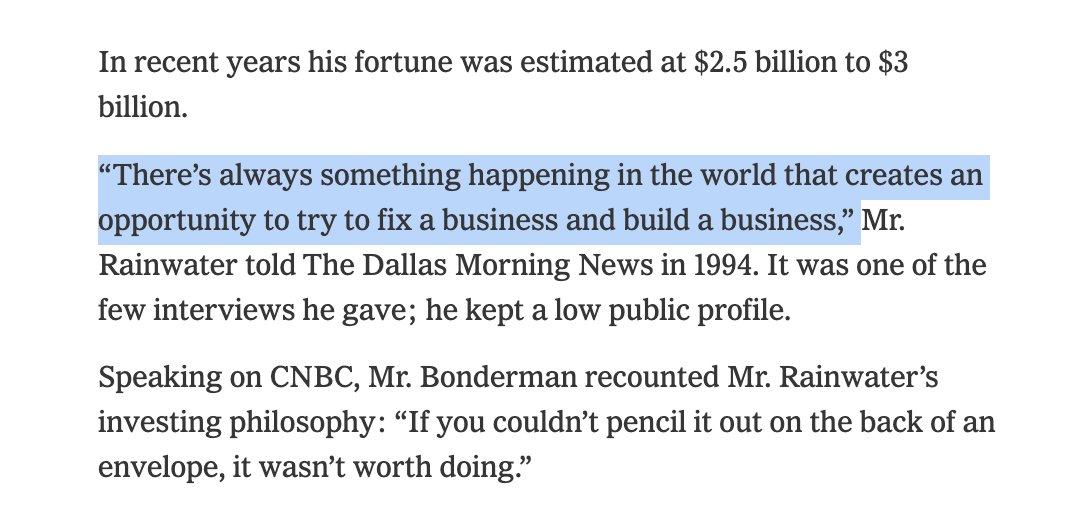

Steve Schwarzman (CEO of Blackstone) on finding opportunity https://t.co/B8SiLyNC1o

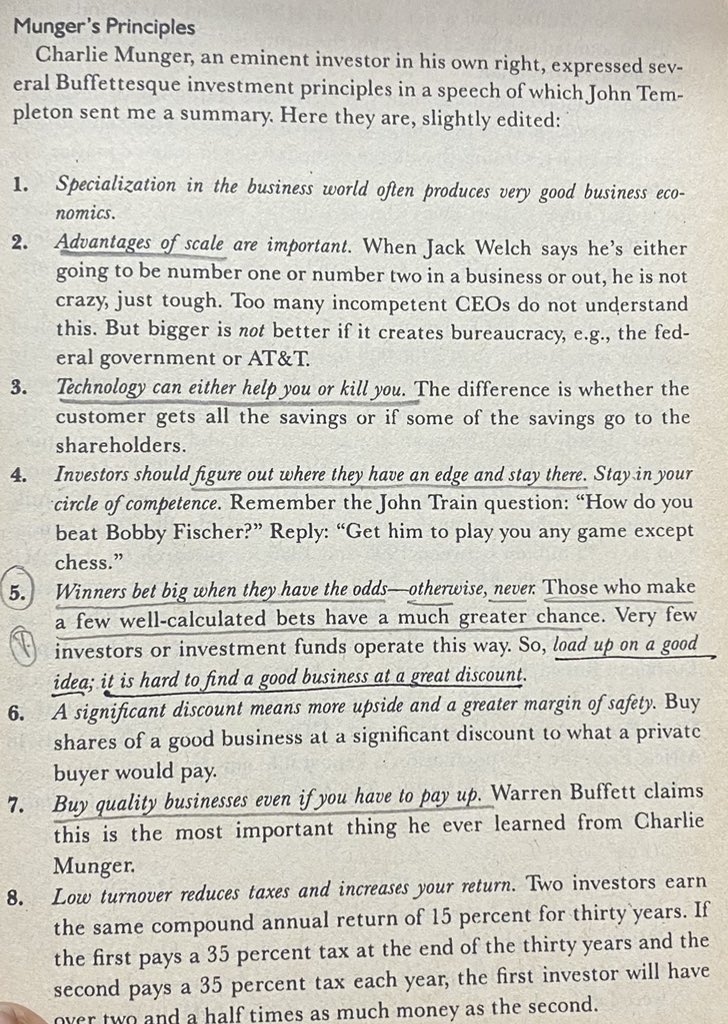

prayingforexits 🏴☠️x.com"Warren Buffett never tried to make the most money. He never tried to get rich quickly. He tried to get rich slow, and I feel like that's what value investing is; it's a philosophy that stays away from the hot flashy trendy investments and focuses more on never losing big."