Saved by Tom Hadley and

Saved by Tom Hadley and

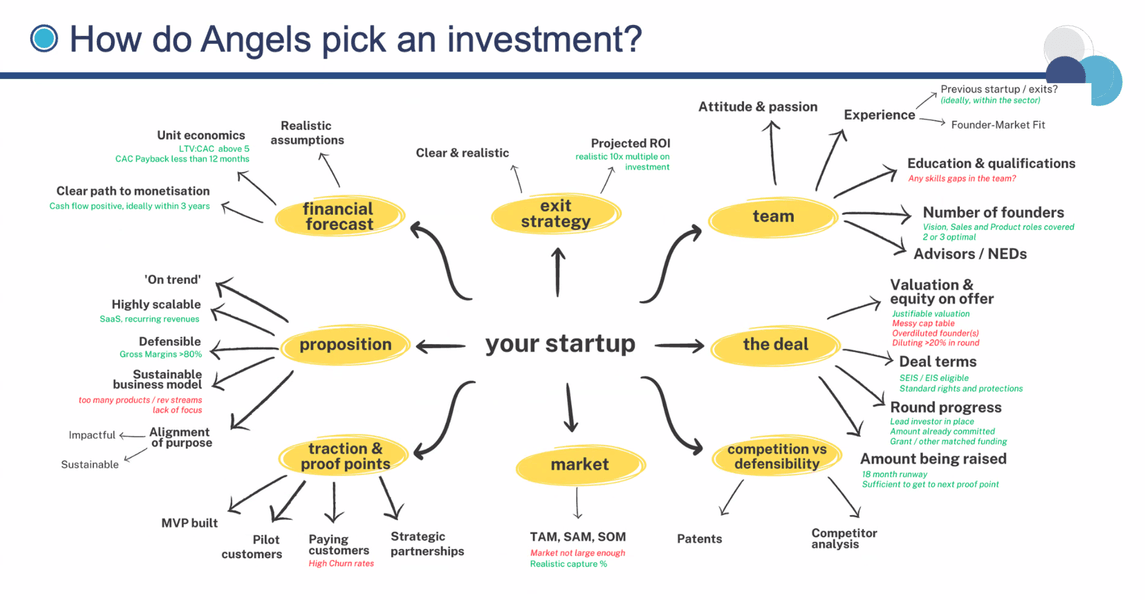

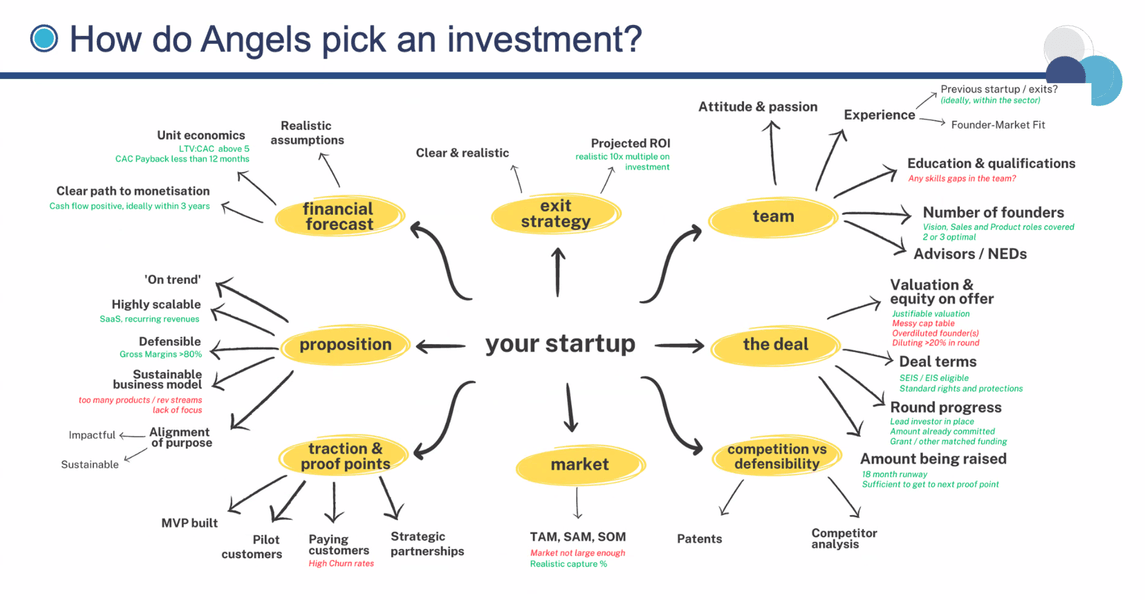

There are many ways for a business to fail, but for it to succeed, it needs to do just about everything right. That's why successful angels try to look objectively at as many factors as they can, and place their money on companies that can check all (or nearly all) the boxes. Each situation is different, but let me walk you through what we look for

... See more