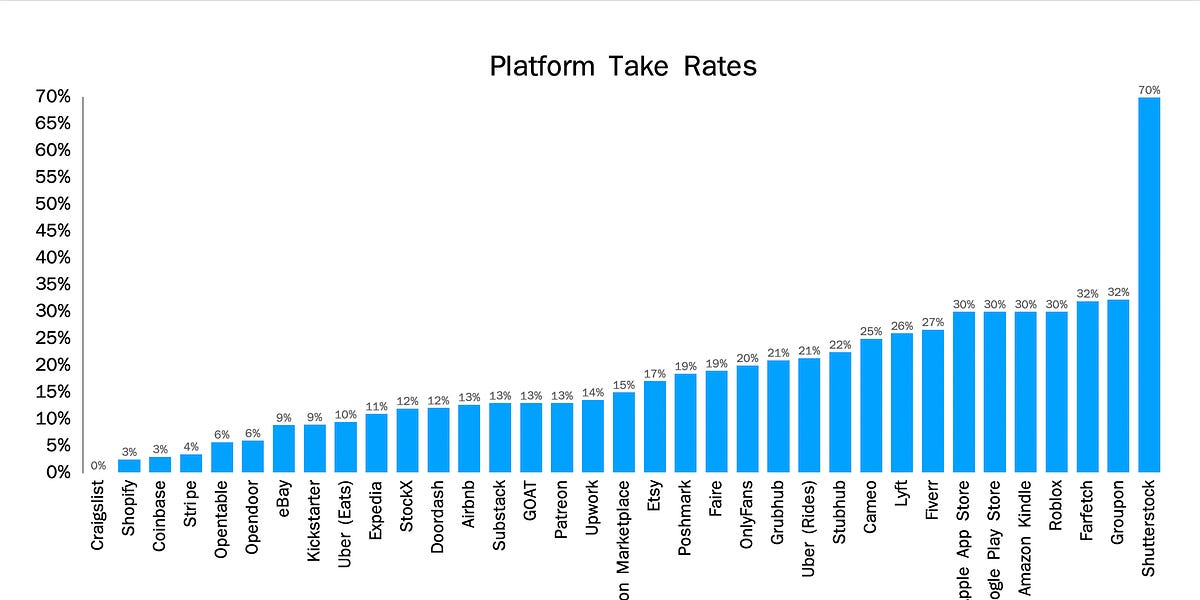

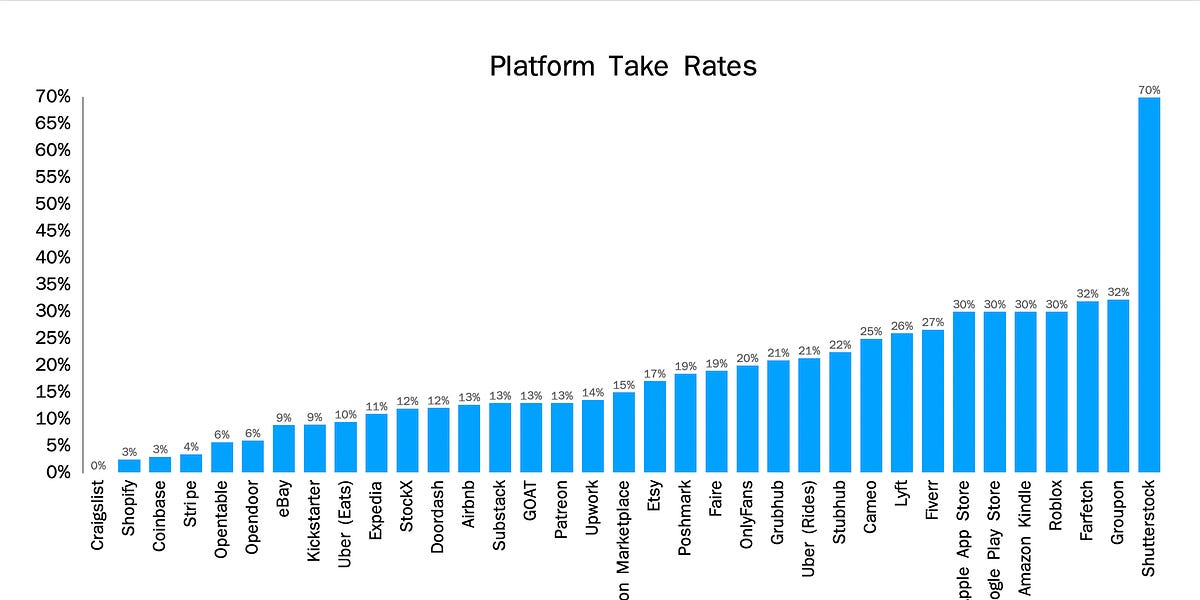

Uber is the quintessential example of a marketplace with low transaction complexity and asymmetry. Matching demand and supply is simply a function of availability and pickup time — commissions are the obvious fit here. On the other hand, marketplaces like Classpass and Scoutbee avoid commissions entirely.