Asymmetric Market Update™️ #30

Please enjoy this special Post-Election Landscape episode of the "Marc & Ben Show"! 🇺🇸🚀💥

01:05 – Two disclaimers

01:42 – Recap of the last four years

07:15 – Debanking & impact on founders

13:38 – Biden admin's crypto crackdown

14:25 –... See more

Marc Andreessen 🇺🇸x.comNow, many potential catalysts for Bitcoin (and crypto generally) will rise in 2025. Here are a few:

- A Strategic Bitcoin Reserve (at the U.S. Federal level)

- Strategic Bitcoin Reserves (at the U.S. State level)

- Strategic Bitcoin Reserves (for other countries globally)

- The removal of SAB-121

- Clear regulations out of the SEC and CFTC on crypto

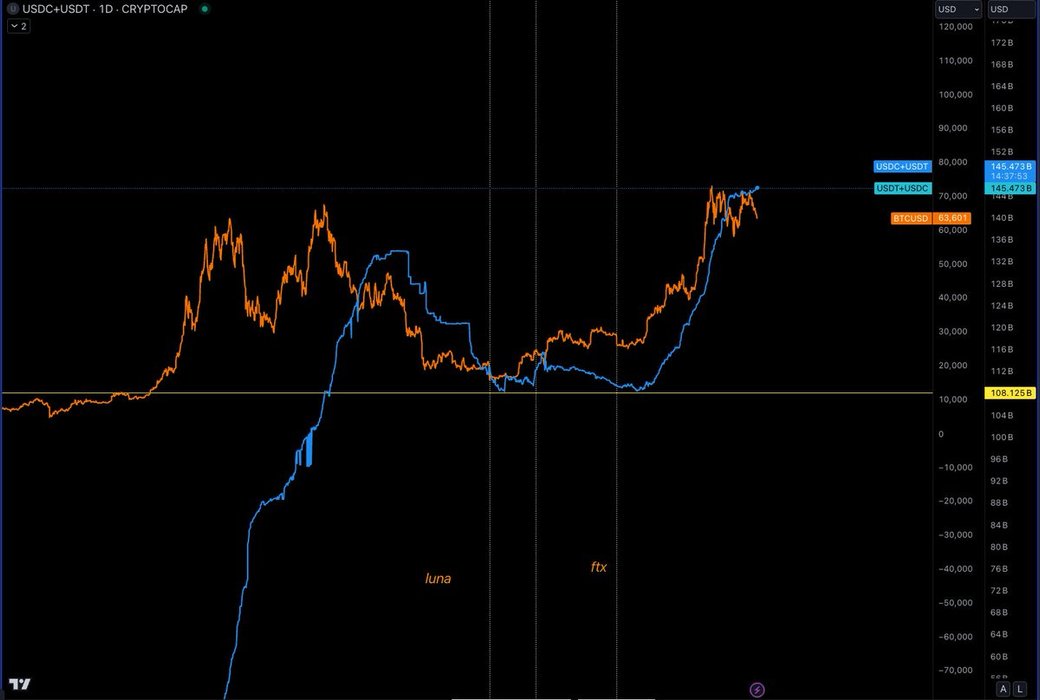

- The Stablecoin

Asymmetric Market Update™️ #25

The End of The Beginning

aitkenadvisors.com

The US is likely heading toward:

Investment Implications

- Lower rates (circa 3%) despite near-term inflation

- More liquidity injections (US$1.5 trillion in 2026)

- Continued unconventional policy tools (Treasury QE, stable coin-driven demand)

Investment Implications

- Risk-On: favor Bitcoin, equities, and growth assets

- Watch for Fed rate cuts and monitor US Treasury bill

Crescendo

Welcome to Bear Town (?) 🐻

My primary focus for @tangent_xyz is two things:

1) Investing and working with founders long term on the venture side, and

2) Spotting inflection points on the liquid side to help founders weather them... See more