Sublime

An inspiration engine for ideas

$TWOU's bonds currently trade in the low 50s and yield over 50%. A bondholder group has allegedly formed and is pitching LME.

I reviewed the current situation and just posted my thoughts on the capital structure (loan, bonds, and equity)

Link in bio. #distressed #specialsits #2U #bankruptcy

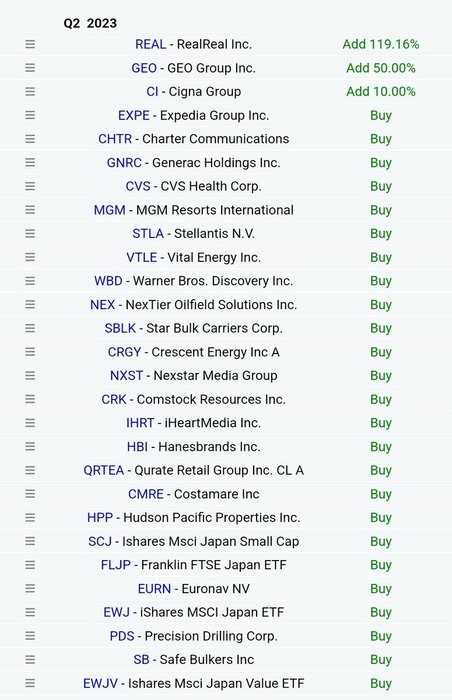

Michael Burry has been on a buying spree!! $CVS $WBD $GEO https://t.co/HNbfmDuYih

Rick Guerin’s write up for: The Security I Like Best

Personal Property Leasing Company

( I’m sure @MohnishPabrai would be interested in this one ) https://t.co/NI9QO9hnPN

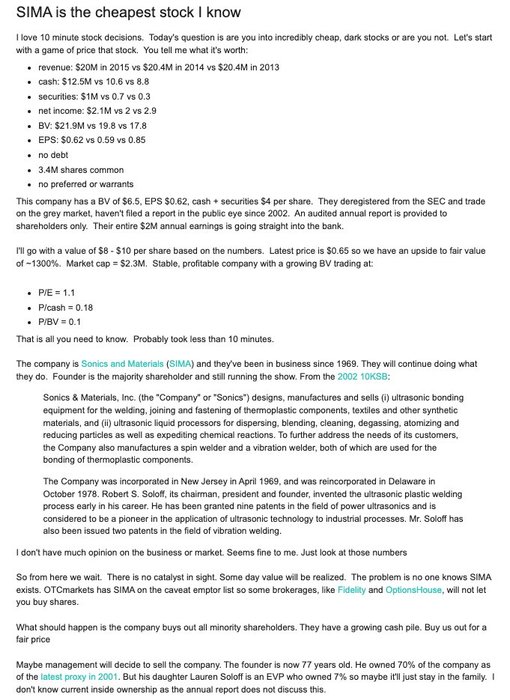

"Of course Buffett crushed it during his partnership days. Stocks were so cheap. You can't find ideas like that anymore. They're all gone."

Dan Schum: "Hold my beer."

Here was the valuation:

• P/E = 1.1

• P/cash = 0.18

• P/BV =... See more

I have been fascinated by the @HindenburgRes $IEP situation, and there are some interesting learnings here. For example, one learns from $IEP that a controlling shareholder of a company with a small float that pays a large dividend can cause his company to trade at a large premium to intrinsic value, best approximated in $IEP by its NAV per share.... See more

Bill Ackmanx.com

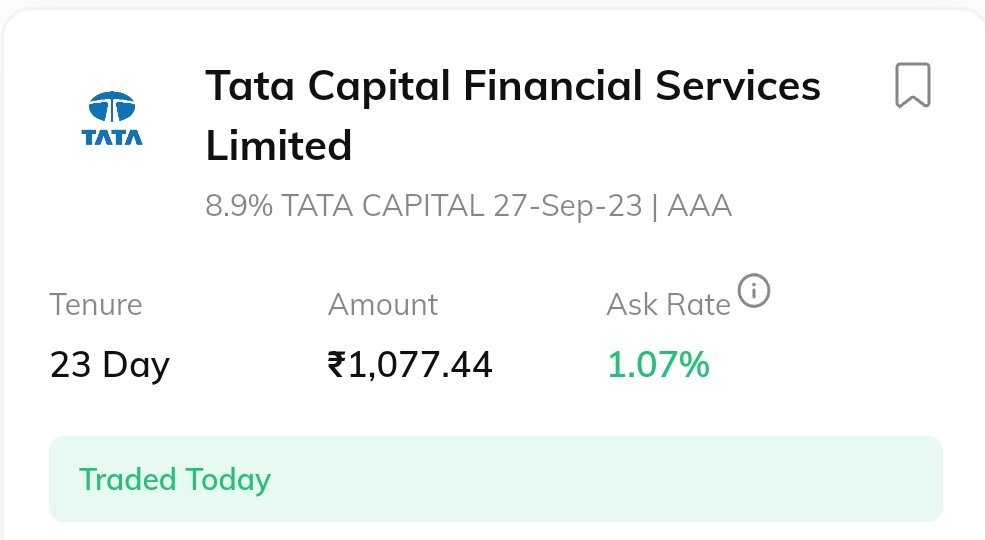

Bonds are boring? 😍 Tata Capital AAA rated bond was on offer for 1.07% for 23 days or 18.45% annualised yield. Bonds can actually make great returns - my discovery of the day. Is TATA, paying 18% interest on its debt ? NO! https://t.co/sXyn8f4mUX

effjay

@effjay