Sublime

An inspiration engine for ideas

Laufer made an early decision that would prove extraordinarily valuable: Medallion would employ a single trading model rather than maintain various models for different investments and market conditions, a style most quantitative firms would embrace. A collection of trading models was simpler and easier to pull off, Laufer acknowledged. But, he arg

... See moreGregory Zuckerman • The Man Who Solved the Market

Recently I've been studying the greatest traders of all time.

Steve Cohen is one of the most infamous figures on Wall St. The billionaire and Mets owner even has a TV show called Billions written around him. Here are some takeaways on what made him so successful.

[THREAD 1/10] https://t.co/ZQplnS5RRU

DR has commoditized “thesis development” and “market research” in VC so larger AUM and more resources no longer an advantage

Lawrence Lundy-Bryan • data-driven VC is over

.@MarioGabelli laying out the sports franchise thesis for $BATRA and $MSGS. https://t.co/AdUCwhxFOZ

Professor Howard Raiffa’s maximum bid of others (or MBOO, pronounced “maboo”) analysis, which captures the fundamental trade-off in graphical form.

Guhan Subramanian • Dealmaking: The New Strategy of Negotiauctions (Second Edition)

a currency went down three days in a row, what were the odds of it going down a fourth day? Do gold prices lead silver prices?

Gregory Zuckerman • The Man Who Solved the Market

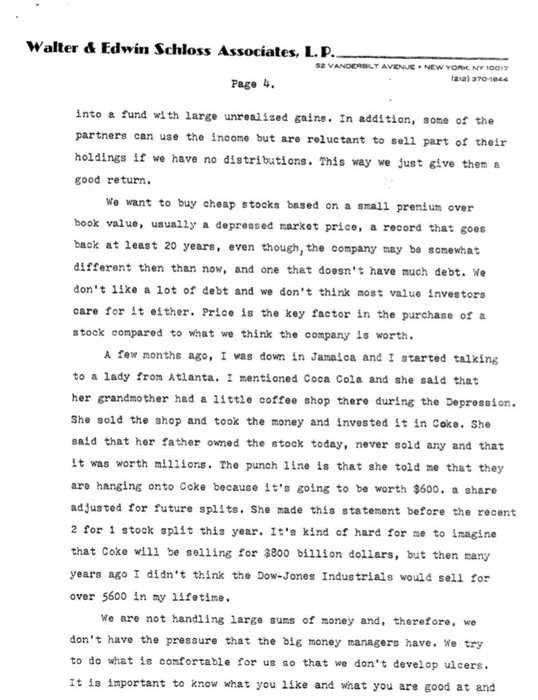

Walter Schloss returned 15.7% per year over 45years.

He wrote this paper explaining why he invests the way he does.

“Why We Invest The Way We Do” by Walter Schloss https://t.co/fYUzSz0GvM