Sublime

An inspiration engine for ideas

But there’s only one way to stay wealthy: some combination of frugality and paranoia.

Morgan Housel • The Psychology of Money: Timeless lessons on wealth, greed, and happiness

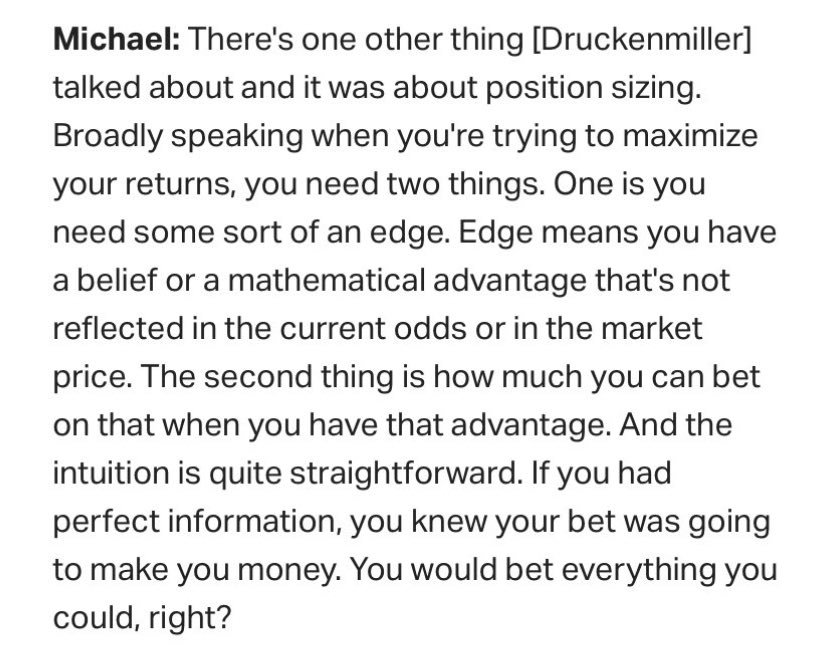

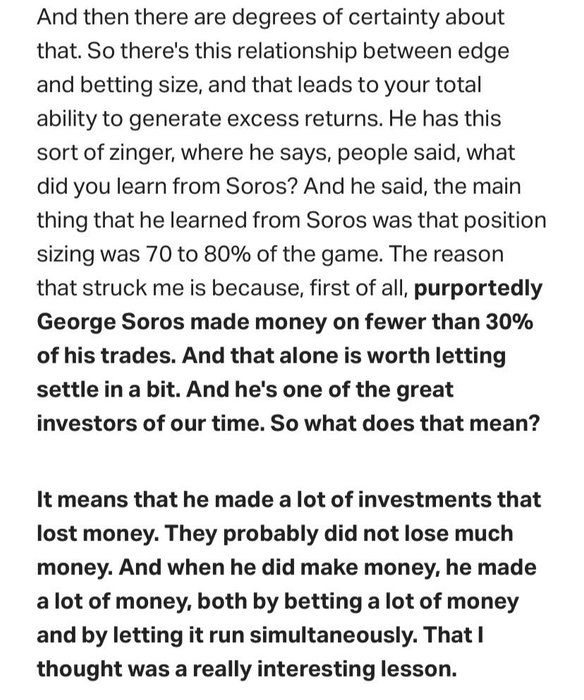

“Position sizing was 70 to 80% of the game. The reason that struck me is because, first of all, purportedly George Soros made money on fewer than 30% of his trades.”

What Stanley Druckenmiller taught Michael Mauboussin on investing https://t.co/PyAHGCrZs0

While the equation might appear formidable, it can be further simplified to edge/odds, which is intuitive in operation. If the Kelly bettor is offered an even-money bet with no edge—for example, a coin flip where the bettor can double, or lose, whatever money is wagered—the optimal bet is zero. The Kelly Criterion won’t allow a bettor to take an

... See moreAllen C. Benello • Concentrated Investing: Strategies of the World's Greatest Concentrated Value Investors

The MARTIN ZWEIGS and CHARLIE D are classics

Book recommendation/educational primers are linked below 🤝🏻 https://t.co/BozoTVzMjg

“Any way you slice it, the Kelly bettor/investor spends a lot of time being less wealthy than he was.”

Poundstone’s book is a must read re: position sizing.

https://t.co/2Jdl0m4eiz

Sidecar Investorx.com