Sublime

An inspiration engine for ideas

Investment thoughts

Balázs Búzás • 1 card

Every investor should pick a strategy that has the highest odds of successfully meeting their goals. And I think for most investors, dollar-cost averaging into a low-cost index fund will provide the highest odds of long-term success.

Morgan Housel • The Psychology of Money: Timeless lessons on wealth, greed, and happiness

I have run the Fidelity Low-Priced Stock Fund (FLPSX) with an intrinsic value approach since 1989, and it has outperformed both the Russell 2000 and Standard & Poor’s 500 indexes by 4 percentage points a year. Over twenty-seven years, a dollar invested in FLPSX grew to $32, while a dollar invested in the index grew to $12.

Joel Tillinghast • Big Money Thinks Small: Biases, Blind Spots, and Smarter Investing (Columbia Business School Publishing)

Howie, inside Morgan Stanley, would lose $9 billion on a single mortgage trade, and remain essentially unknown, without anyone beyond a small circle inside Morgan Stanley ever hearing about what he’d done, or why.

Michael Lewis • The Big Short: Inside the Doomsday Machine

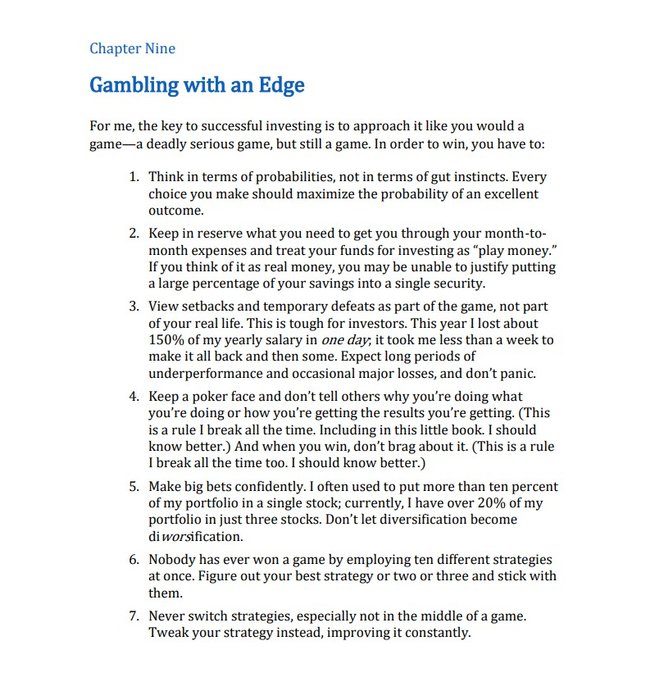

The Little Book of Hedge Funds | Summary, Quotes, Audio

sobrief.com

Buffett’s genius was largely a genius of character—of patience, discipline, and rationality.

Roger Lowenstein • Buffett: The Making of an American Capitalist

When asked if private investors can draw any lessons from what Harvard does, Mr. Meyer responded, “Yes. First, get diversified. Come up with a portfolio that covers a lot of asset classes. Second, you want to keep your fees low.