Sublime

An inspiration engine for ideas

3 things separate good vs. bad financial modeling.

But the difference is enormous.

Like & comment if you want the excel.

7 points:

*1) Model setup*

The attached shows "bad modeler" on the left vs. "good... See more

Corporate Prediction Markets: Evidence from Google, Ford, and Koch Industries

The document examines the efficiency of corporate prediction markets at Google, Ford, and Koch Industries, and finds that despite some inefficiencies, these markets perform reasonably well.

erim.eur.nl

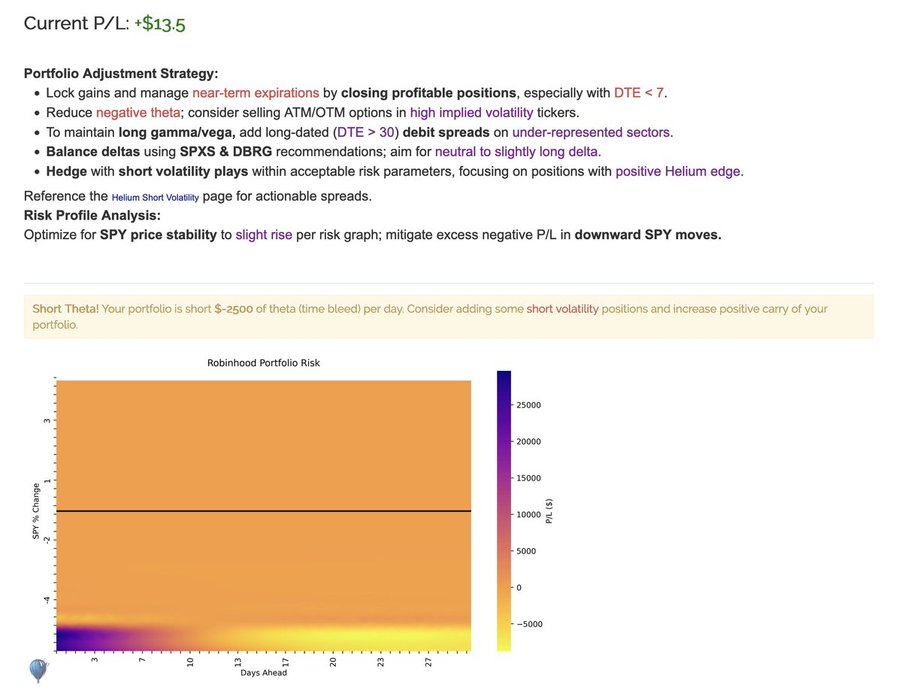

Personalized portfolio feedback based on your portfolio risk graph

https://t.co/vsvEgayPiY https://t.co/0wF2cxTnnW

Here are some of the financial metrics I optimise my portfolio for: https://t.co/M755n4MLjy

Financial Planning

Mary Martin • 5 cards

For curiosity's sake, I've decided to start tracking the performance of fintwit favorites (based on my feed experience)

Here are 20 darlings that I will equally weigh at 5% and then check their performance over a one and three-year timeframe

Feel free to give me some recommendations on how I... See more

Mikro Kap Davidx.comFinancial Advisor

Anthony Fiedler • 3 cards

PyPortfolioOpt: A Python library that implements portfolio optimization methods:

1. Classical mean-variance optimization techniques and Black-Litterman allocation

2. Shrinkage and Hierarchical Risk Parity.

Available free on GitHub: https://t.co/FNSJmEw6il