Sublime

An inspiration engine for ideas

In investing, average is great.

Ramit Sethi • I Will Teach You to Be Rich, Second Edition: No Guilt. No Excuses. No BS. Just a 6-Week Program That Works

A fantastic story about the father of modern portfolio theory, Harry Markowitz, brings this to life. Markowitz considered the optimal mix of assets for his personal portfolio but found it all too complicated to wrap his prodigious brain around. “I should have computed the historical co-variances of the asset classes and drawn an efficient

... See moreBrian Portnoy • The Geometry of Wealth

I was down 10.8% in Q4, which left me down 18.7% on the year. Cumulative rate of return (since the start of 2021, when I became free to trade stocks) stood at 228.6% at year's end.

Eric Jhonsax.comIt’s a pleasure to listen to @philippilk - one of the few professional economists prepared to jump over the sterile ‘fact and value’ divide which has hampered the discipline for decades. 👏👏👏

(Link to speech below) https://t.co/9swPLJCDbe

William Clouston SDPx.com

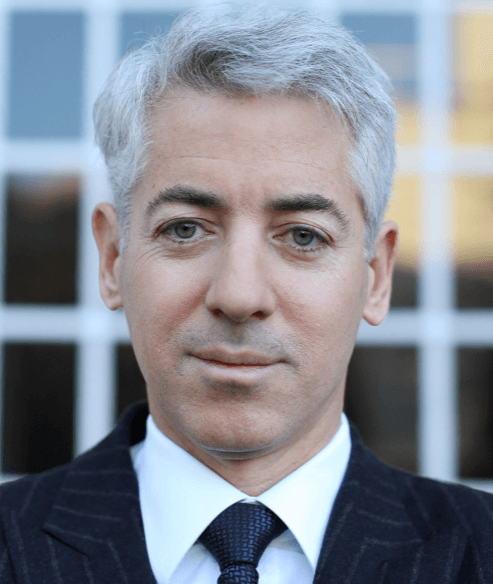

Bill Ackman Manages Over $8.7 Billion in Assets

Achieved 373% accumulative return 2004-2010.

A 58% return in 2019!

He makes all of his Analysts read these 11 books:

📚 https://t.co/XomKpXdDVI

Tell em why you mad son!!

My family office is awesome.

- focus more on logistics of life than investing. Eg mortgages, tracking, family planning

- more focused on helping me think and plan than investing

- don’t hold any assets

- have great... See more

Jesse Pujjix.com