Sublime

An inspiration engine for ideas

How to explain an idea: a mega post

markpollard.net

It’s easier to act your way into a new way of thinking than to think your way into a new way of acting.

Tacit: Fingal Ferguson, Master Knifemaker

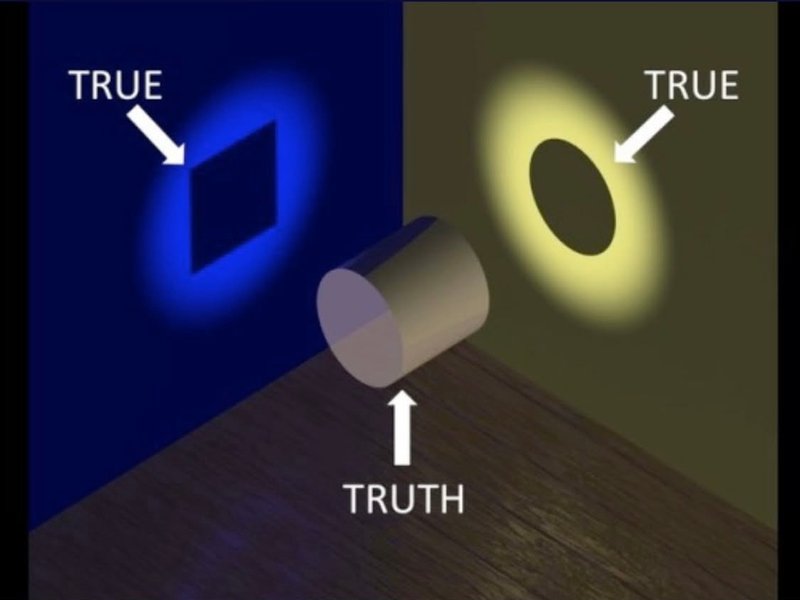

youtube.comWe used to think that the earth is flat. Galileo was convicted of heresy for teaching that the earth isn’t the center of the universe and that it revolves around the sun. We used to ridicule scientists claiming that invisible germs could harm us (until we could see them through advanced microscopes). The list could go on and on. It’s easy in

... See moreMark Gober • An End to Upside Down Thinking: Dispelling the Myth That the Brain Produces Consciousness, and the Implications for Everyday Life

bitterness as a crutch

youtube.comWe delight in the beauty of the butterfly but rarely admit the changes it has gone through to achieve that beauty.

-Maya Angelou