Sublime

An inspiration engine for ideas

Non-commodative Economy

Morgan • 2 cards

NASDAQ call volume spiked minutes before the 90 day tariff pause was announced.

Not a good look at all. https://t.co/SeF7Hfn2SM

It struck me as an instance of regulatory empire building—a classic Washington maneuver: recognize a new innovation in order to force ever more businesses into the regulatory framework.

J. Christopher Giancarlo, Cameron Winklevoss, • CryptoDad: The Fight for the Future of Money

This trader turned $2 million into $20 million.

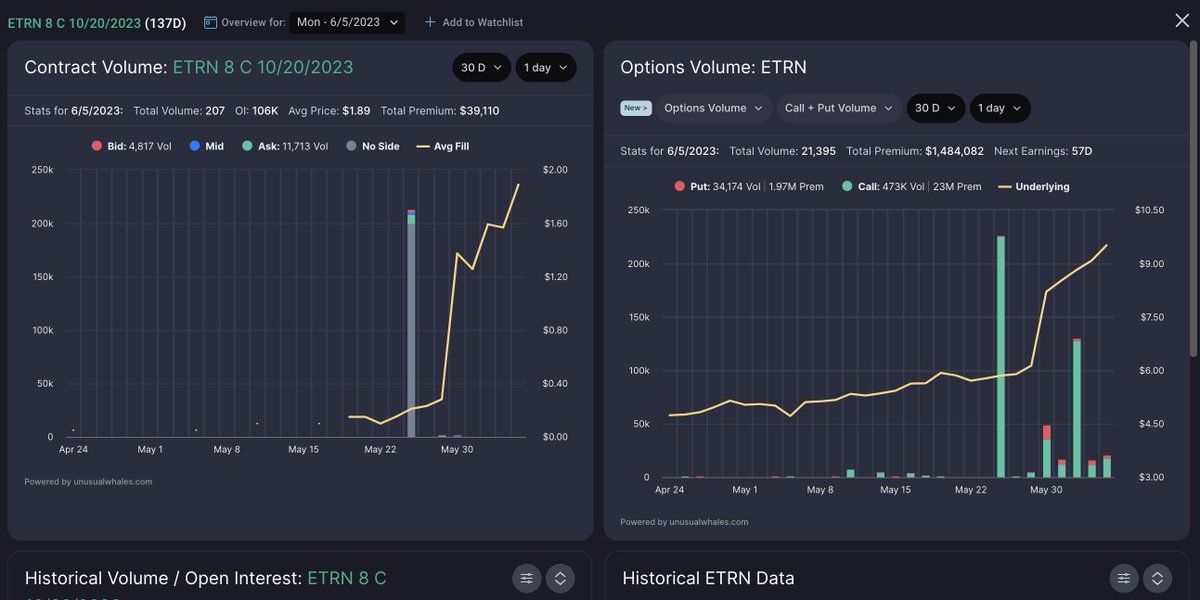

May 24 11:18 - 11:24am, a trader loads $ETRN $8 Oct calls.

May 27, debt deal passes, with a surprise pipeline for $ETRN.

The contracts rallied +1000%.

Someone always knows, & it... See more

#SPX up 3.5 times since Y2K. US Fed debt x10 and #gold x13. Interest rates irrelevant

CrossBorder Capital/ GLIndexesx.com

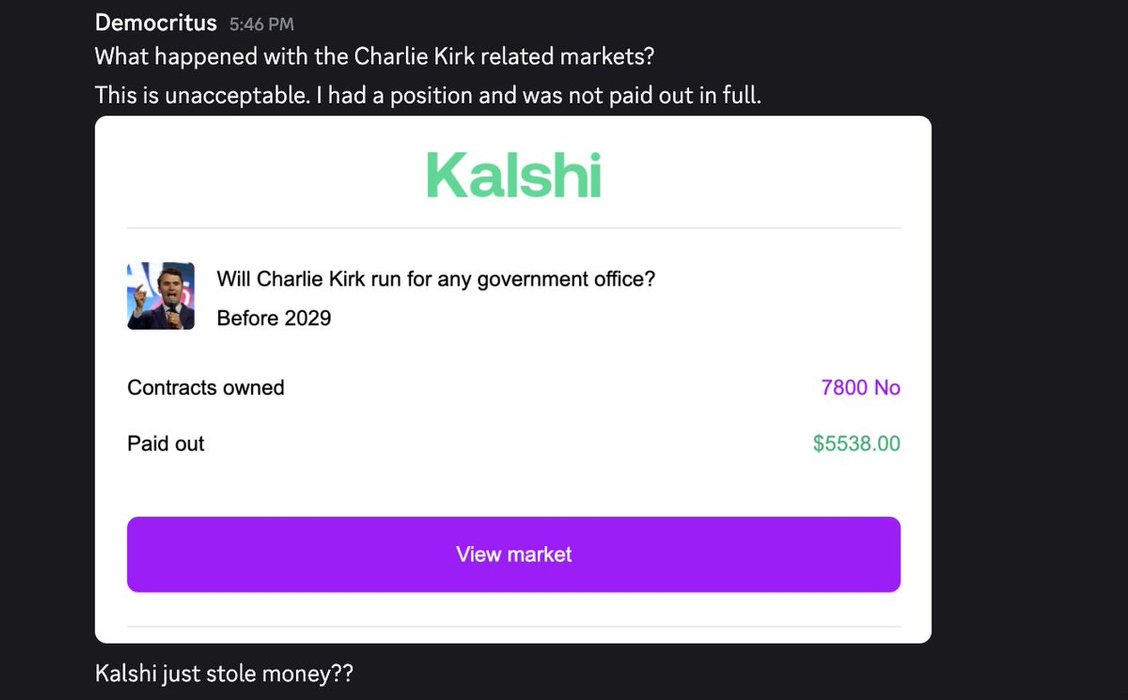

Kalshi offered Charlie Kirk contracts on a range of topics entering the day. Policy is to settle them at what the "fair market price" was before news. People who lost money despite betting he wouldn't do things are not happy.

This is an insane world. https://t.co/rUDhThg47V

Otherwise, the author has found that price-revolutions in general are (with some exceptions) entirely unknown to most economists, political leaders, social planners, business executives, and individual investors, even as they struggle to deal with one price-revolution in particular.5

David Hackett Fischer • The Great Wave

As I mentioned to Mercer, I have often expressed my disdain for this approach as an “outsider trading” scandal. If