Sublime

An inspiration engine for ideas

Coulter

@coulter

Founders always share investor meeting details with each other and your reputation is everything in our industry. If you are helpful, present, and considerate, then you’re going to get a great reputation. If you are unprofessional, cavalier, or conceited, or use your position of power in any way that isn’t in service of the founder, then you’re

... See moreJason Calacanis • Angel: How to Invest in Technology Startups—Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000

Robert Richman

@robbe

CEO/Founders

Marine Buclon-Ducasse • 15 cards

Business Council and the Economic Club of New York,

Brad Jacobs • How to Make a Few Billion Dollars

Trends – Artificial Intelligence (AI) – May 2025 – BOND

The document analyzes rapid growth and transformative trends in artificial intelligence, highlighting unprecedented user adoption, technological advances, global competition, enterprise AI integration, and associated benefits and risks shaping the future.

bondcap.comMarc Palatucci

@map415

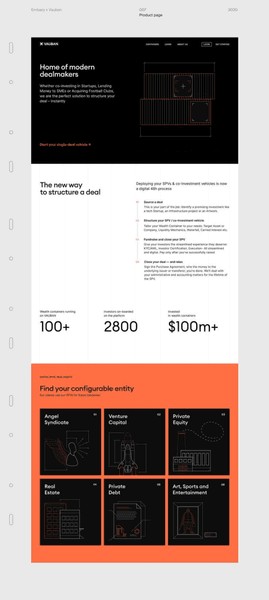

Fund administration, public accounting CPA - Liccar Inc.

liccar.com