Sublime

An inspiration engine for ideas

$TWOU's bonds currently trade in the low 50s and yield over 50%. A bondholder group has allegedly formed and is pitching LME.

I reviewed the current situation and just posted my thoughts on the capital structure (loan, bonds, and equity)

Link in bio. #distressed #specialsits #2U #bankruptcy

Last month, I shared my thoughts on Brookfield--a Canadian stock that arouses strong opinions from bulls and bears alike. $BN is undeniably cheap, but with its complex structure and floating rate debt, some find it risky.

When I wrote about BN, I focused on the company's notorious complexity, making the case that it's... See more

Fundamental Equity Analysis: A Primer

https://t.co/xz4Qu4TLGb https://t.co/uWqt0bzFk0

[Tidewater] sold $250MM of senior unsecured bonds maturing in 2028 with a 10 3/8% coupon at a price of 99.

- they now trade at 102 to yield 9.8%, a spread of 522 basis points over Treasurys, or 124 basis points wider than the average single-B spread.

- implies they are “deep junk”... See more

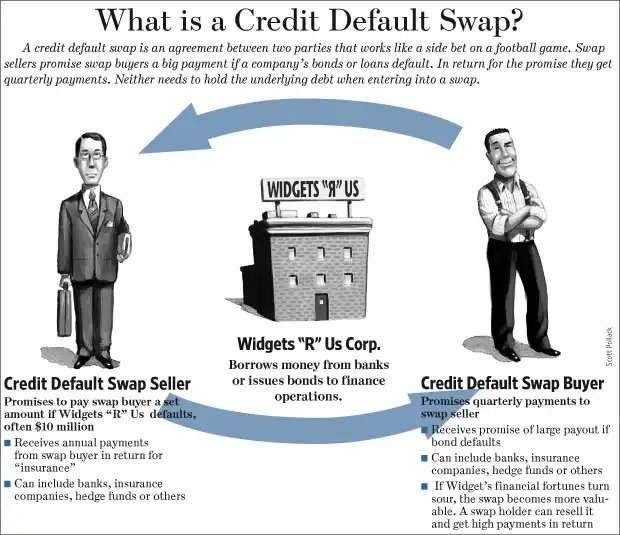

The story of how Bill Ackman made a billion dollars by shorting MBIA. Arguably, this is the trade that turned him into a celebrity investor

Investment Cost: $64 million

Total Proceeds: $1.2 billion

Multiple of Capital (MOC): 18.5x

In 2002, Bill Ackman published a... See more

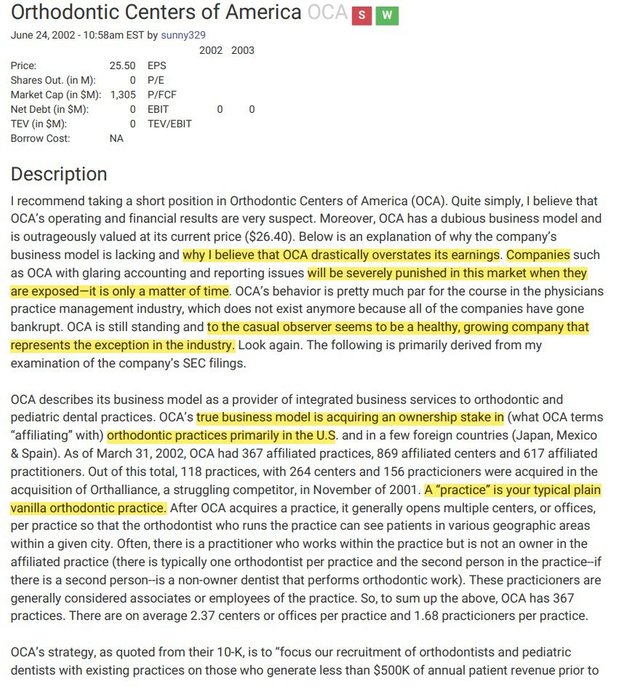

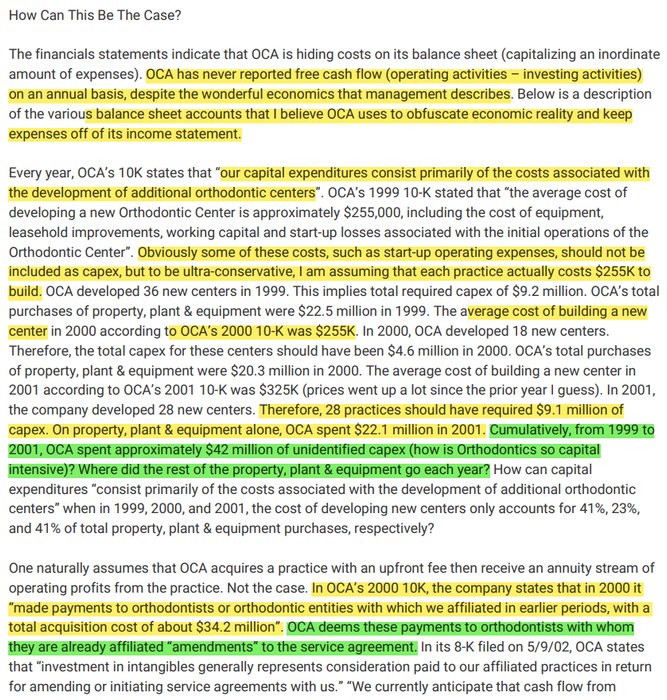

I was just re-reading this short pitch, and it’s just as fun each time.

If you're looking to improve your forensic accounting skills, this is the write-up to read.

By the way, the author ended up landing a job at a fund as a result of this pitch. (Link to the full pitch below)... See more

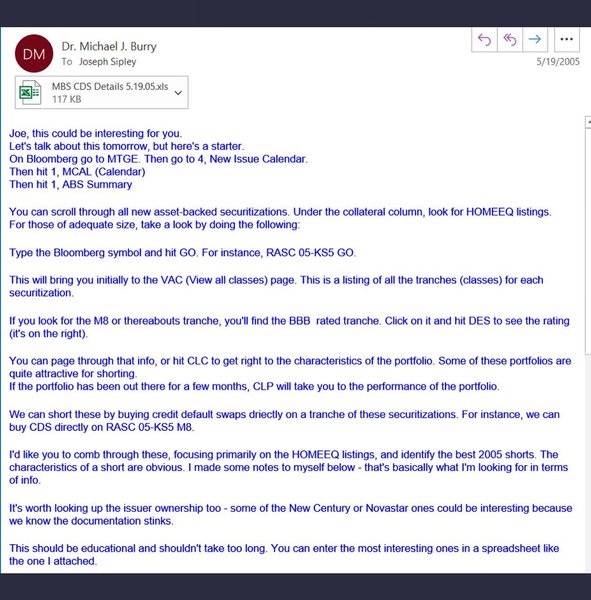

Dr. burry be wilin on twitter these days - some original due diligence #bubble #2008 #drburry #thebigshort #bigshort #stocks #crypto

instagram.com