Sublime

An inspiration engine for ideas

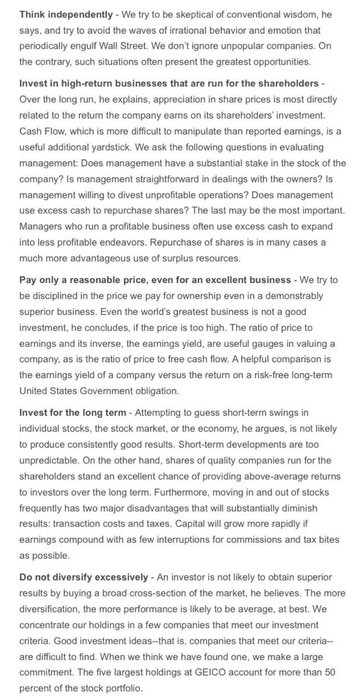

Louis Simpson was able to average a 20% annual gain over the 24yrs he was in charge of GEICO’s $4 billion portfolio.

In this Washington Post interview he laid down his investment philosophy https://t.co/6urwYgOXU1

Human nature usually tells us that work is good. The more we work out, the stronger we get. The harder we work at our job, the better results we see. But in investing, that human nature works against us. In investing, it's almost always the LESS we do, the better our investments perform.

Jack Bogle (founder of Vanguard,... See more

instagram.comInvestor Communications

sari and • 10 cards

investing

Aleks Pausak • 2 cards

What I'm digging into this week...

-Warren Buffett and Greg Abel talk Japan on Squawk Pod

-Jeremy Grantham on TIP

-@chriswmayer talks 100 Baggers

-Charles Ellis on The Loser's Game

-Tom Gayner chats with @WilliamGreen72

Sources below

Brad Kaellnerx.comIf you love taking risks and don’t mind being locked up for a decade, I could see you putting 10 to 20 percent of your bankroll into angel investing. If you can tolerate risk, but don’t love it, and you can handle being illiquid for a decade, I could see you putting 5 percent of your bankroll into angel investing.

Jason Calacanis • Angel: How to Invest in Technology Startups—Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000

Finance App

Alden Huschle • 3 cards