Sublime

An inspiration engine for ideas

In statistical distributions with thick tails, as Nassim Taleb says, the tail wags the dog . The relevant information is all in the tails, not in the body. Why would an allocator want statistical estimators to ignore the tail and instead overweight the center of the distribution, which is predominantly noise?

An Allocator’s Manifesto: Why is every single fund top quartile?

fat-tailed curves:

Rhiannon Beaubien • The Great Mental Models Volume 1: General Thinking Concepts

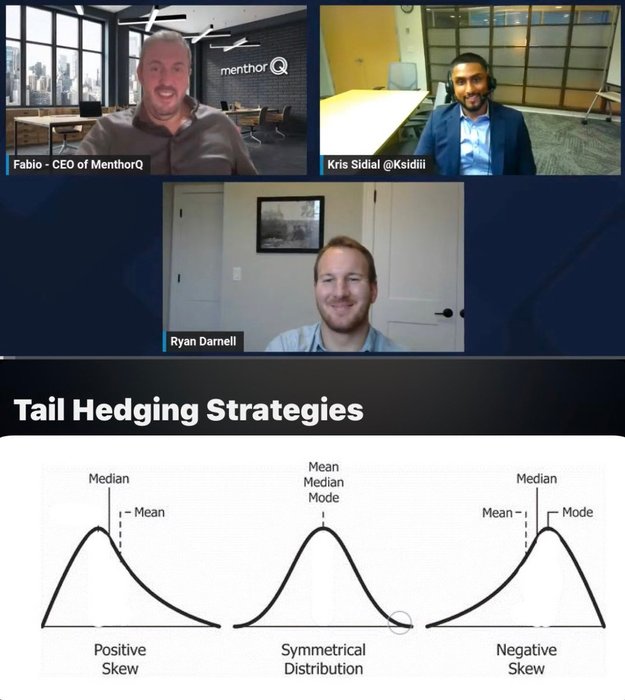

One of my favorite Quant Trading Lectures on Tail Risk Hedging against Black-Swan Events/ Extreme-Volatility, produced by two phenomenal prev-Exotic Derivatives traders & Market Making professionals, Kris Sidial, Ryan Darnell, hosted by prev-Bloomberg/MenthorQ CEO Fabio Ruggeri: https://t.co/BuRE3ZR3N6

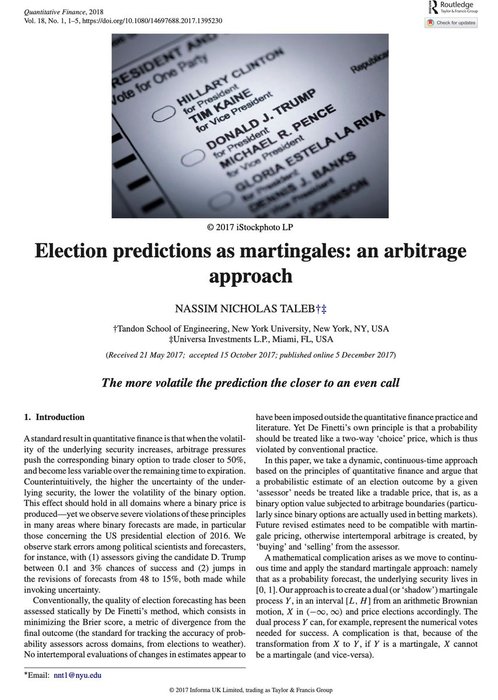

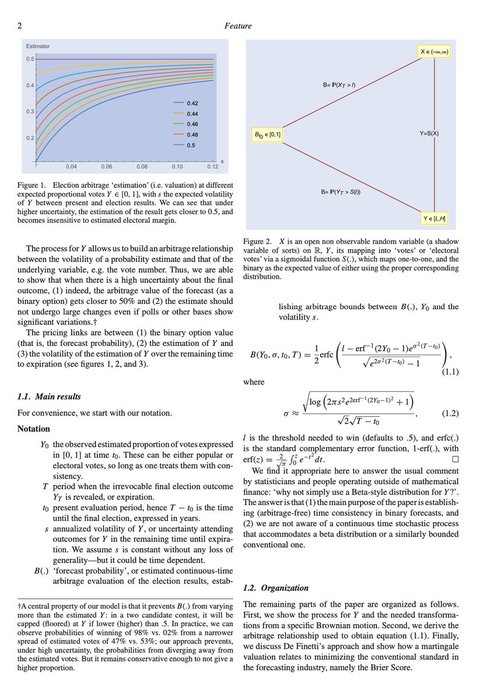

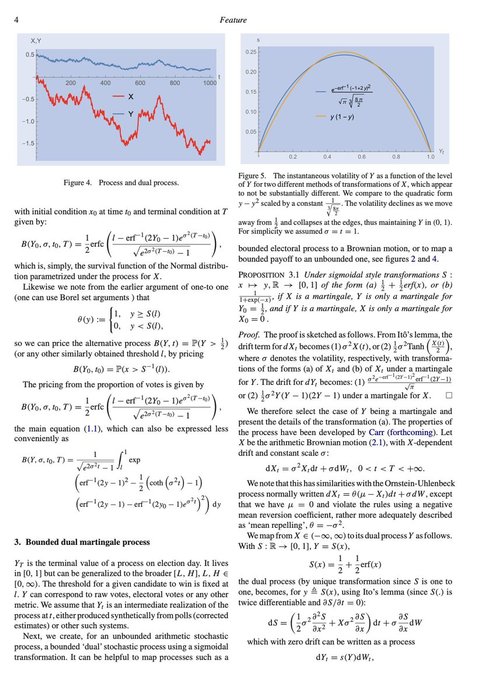

8 Years later, Clueless Nate (Silver) still clueless about probability. https://t.co/ZNUjSKDJHs

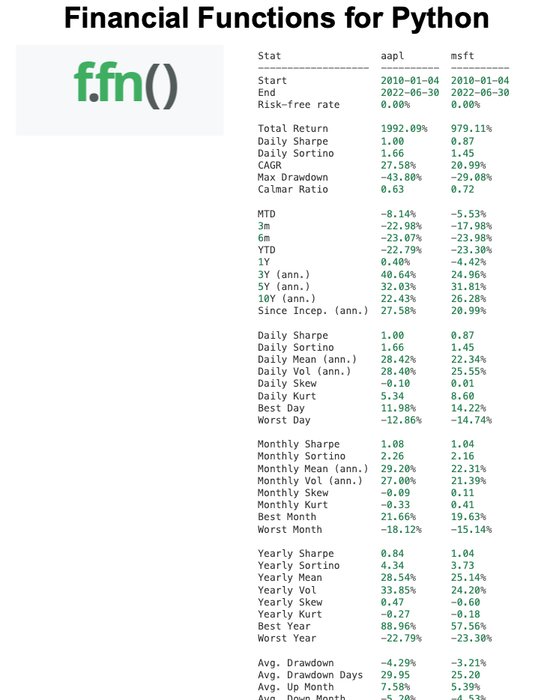

Finance in Python is insane.

Check out the ffn (financial functions for Python)

Let's dive in: https://t.co/4NR7wTogSa

Think of it this way. In a bell curve type of situation, like displaying the distribution of height or weight in a human population, there are outliers on the spectrum of possibility, but the outliers have a fairly well-defined scope. You’ll never meet a man who is ten times the size of an average man. But in a curve with fat tails, like wealth,

... See more