Sublime

An inspiration engine for ideas

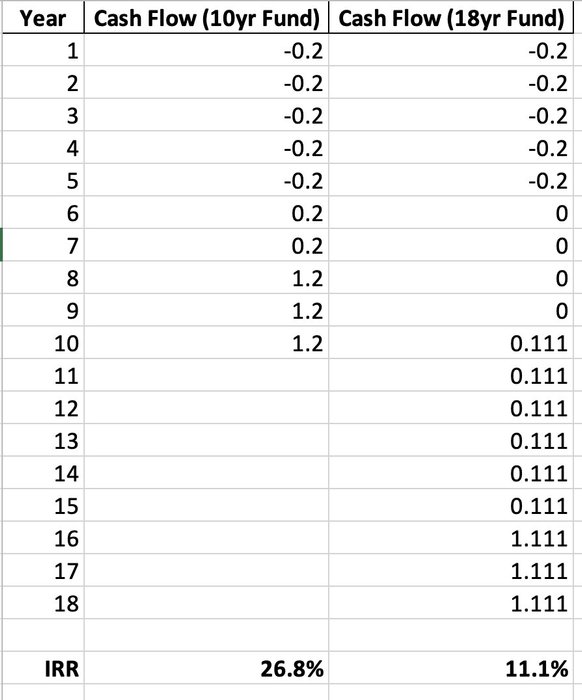

I've spoken to a lot of VCs and GPs in my career - and here is what many of them miss:

In venture, "how fast you win" matters just as much as "how much you win".

Imagine if you ran a venture fund that has 4x gross return (top quartile performance) - with the following... See more

Public markets reward predictability.

Patrick Vernon • Venture Capital Strategy: How to Think Like a Venture Capitalist

What does retiring at Gumroad look like?

(Available for product designers, software engineers, and customer support people at the moment only)

- Get paid hourly ($125-$200/hr)

- Choose your equity split (0-80%)

- Get paid to exercise (= 409a price)

-... See more

Sahil Lavingiax.com1/

Get a cup of coffee.

In this thread, I'll walk you through a simple way to compare the effectiveness of *dividends* vs *share buybacks*.

10-K Diverx.comdefined contribution

Richard H. Thaler • Nudge: The Final Edition

Does Management Hog Most of the Stock Options Granted in a Given Year, or Do Rank-and-File Employees Share in the Wealth? Generally, firms with more equitable distribution schemes perform better over the long run.