Sublime

An inspiration engine for ideas

My goal is cash flow within the first month.

Justin Donald • The Lifestyle Investor: The 10 Commandments of Cash Flow Investing for Passive Income and Financial Freedom

Take that 9-5 money and buy income

Buy an ATM machine

Buy a vending machine

Buy a rental property

Buy dividends paying stocks

Buy a car to rent to Lyft & Uber drivers

You... See more

WealthSquad Chris 🌴x.com

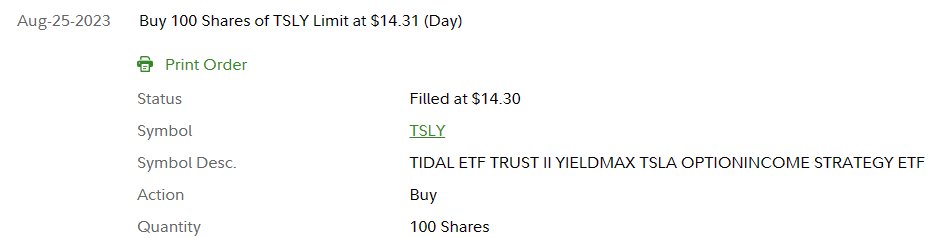

Just bought 100 shares of $TSLY for $14.30 each

Lets see how this goes 😎📈🕵️♂️ https://t.co/1ATmXIU8ew

Now, I reiterate, Fastlane wealth is created by the net income and asset value—not by the stock market or compound interest. Your Fastlane business should fund this account, not savings from your paycheck.

MJ DeMarco • The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a Lifetime

Acquérir ou créer des actifs qui génèrent un revenu, c’est faire travailler l’argent pour vous. Les emplois bien rémunérés signifient deux choses: vous travaillez pour l’argent et les impôts que vous payez augmenteront probablement. J’ai appris à faire travailler l’argent pour moi et à bénéficier d’avantages fiscaux, car mon revenu n’est pas un

... See moreRobert T. Kiyosaki • Père riche père pauvre - édition 20e anniversaire (French Edition)

Divvy makes most of its money from rent, but also from the appreciation of the home at sale.

Tomio Geron • Startups That Offer New Paths to Homeownership

Pulled just over $300K in savings from Chase for a client. She was getting .01%.

If we can get the current 3-month treasury yield of 5.55% for a year, she’ll earn $17K+ in income (I typically use the SGOV ETF to pursue this).

The tradeoff for that income, with the new lower account balance... See more

Rubin J. Miller, CFAx.com

Don’t spend $3,000 on the newest MacBook.

Instead, invest in a Smart Cooler that can pay you $3,000 every month.

(I own 5 of these that each make ~$3k/month)

Best part?

No big down payment needed.

Here's... See more