Sublime

An inspiration engine for ideas

GLP1s have added $1T in market cap to Eli and Novo over the last 5 years. That's 3x+ the market cap created by all biopharma startups over the last 30 years combined. This is a bit of an indicment of the biotech startup ecosystem. There are many $1T and even $10T drugs to be invented, we just don't fund them. Through no one persons fault, the... See more

Blake Byersx.com

There’s a fund manager out there I have been following for a few years who consistently nails biotech buyouts. Here are his new buys https://t.co/oLwSS0am8Y

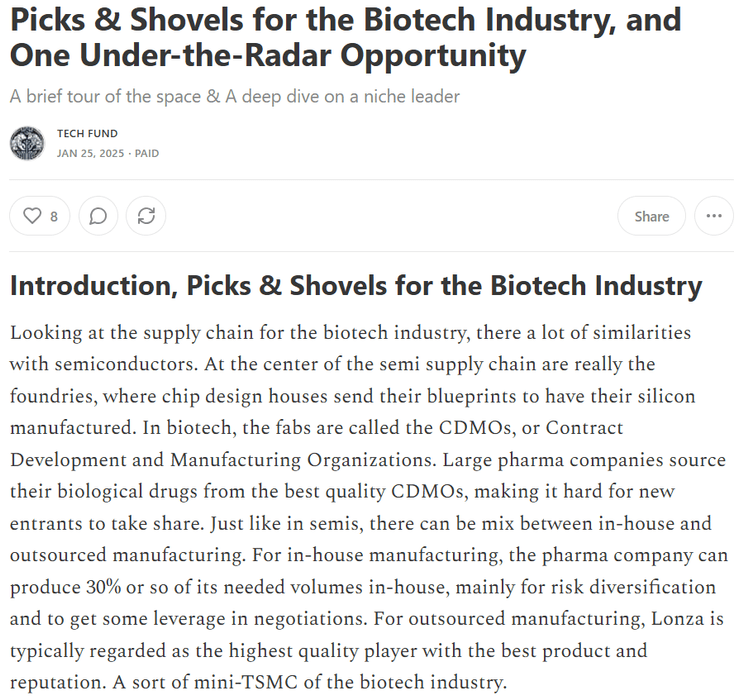

We just published an overview on some of the key names and developments in the picks-and-shovels space for the biotech industry. And there's also a deep dive on a strongly positioned player, we came across this company via a scientist at a major pharma company who mentioned how he is relying on this company. It’s a name we had never even heard of... See more

For Blood and Money: Billionaires, Biotech, and the Quest for a Blockbuster Drug

10 bio companies on the edge of legality and ethics:

- Alcor - freezes people after death (running since 1974; >200 people frozen)

- Viagen - clones animals like cats, dogs, and horses for private owners

- Nectome - brain preservation co aiming at long-term memory preservation (Sam Altman on... See more

Dr. Shelbyx.com

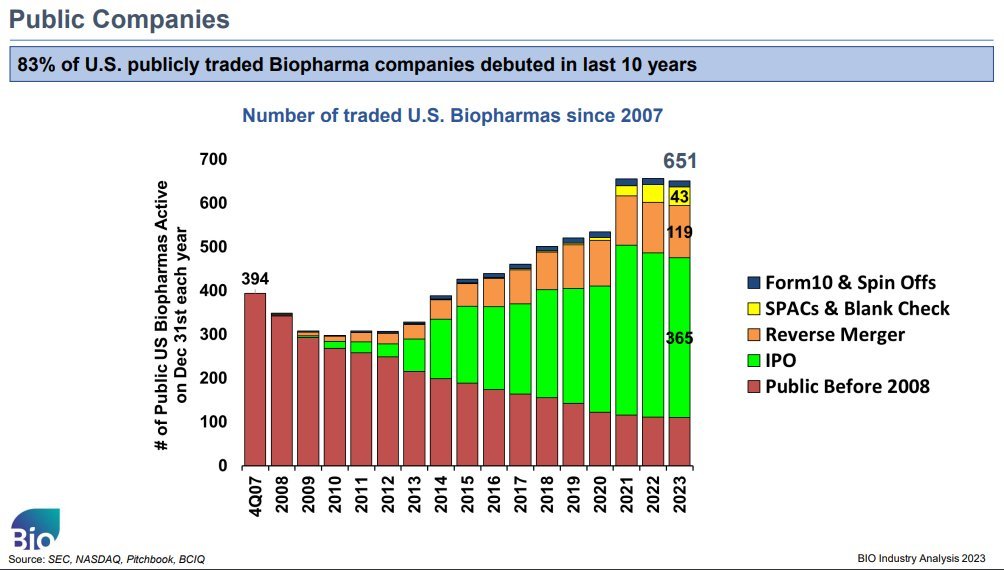

83% of public biotech stocks debuted in the last 10 years,

Biotech is a 'survival of the fittest' industry,

Only the strong survive and cash is the lifeblood,

But the problem with the current batch of #biotech #stocks is...🧵

Chart... See more

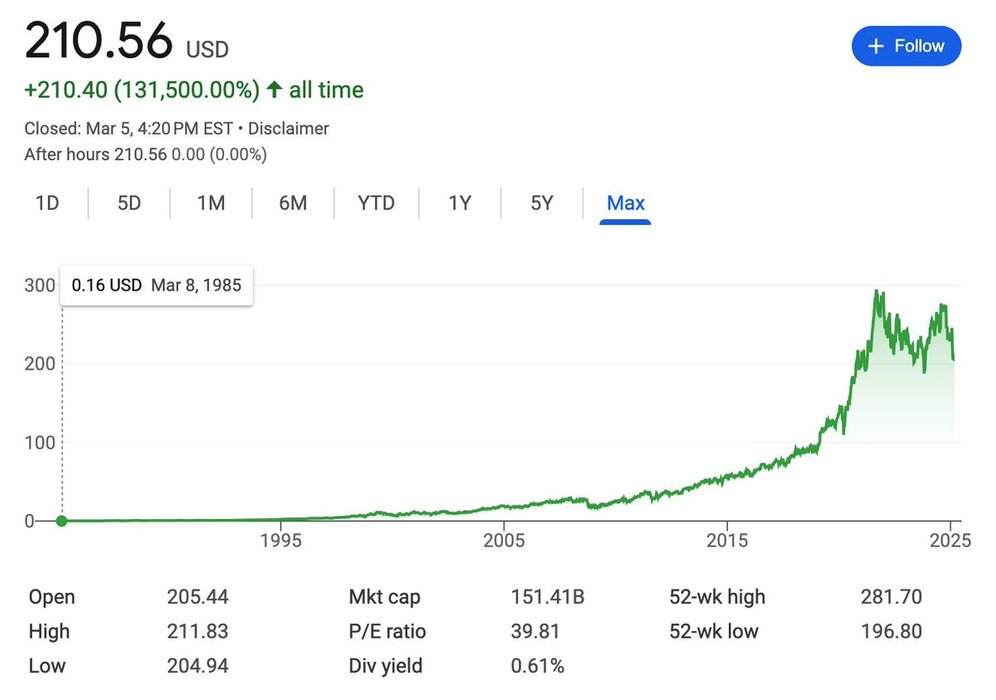

Solving "boring" problems can be lucrative in life science. Danaher is a conglomerate that makes your centrifuges, antibodies, microscopes, etc. Within ~1/2x $AAPL return since '85...without making a drug. "Hard" to replicate but underrated in all the high-flying tech talk. https://t.co/2zVGmHeFkf

Everyone connected in any way to the biotech and pharma world should watch this.

Adam Feuerstein ✡️x.com