Sublime

An inspiration engine for ideas

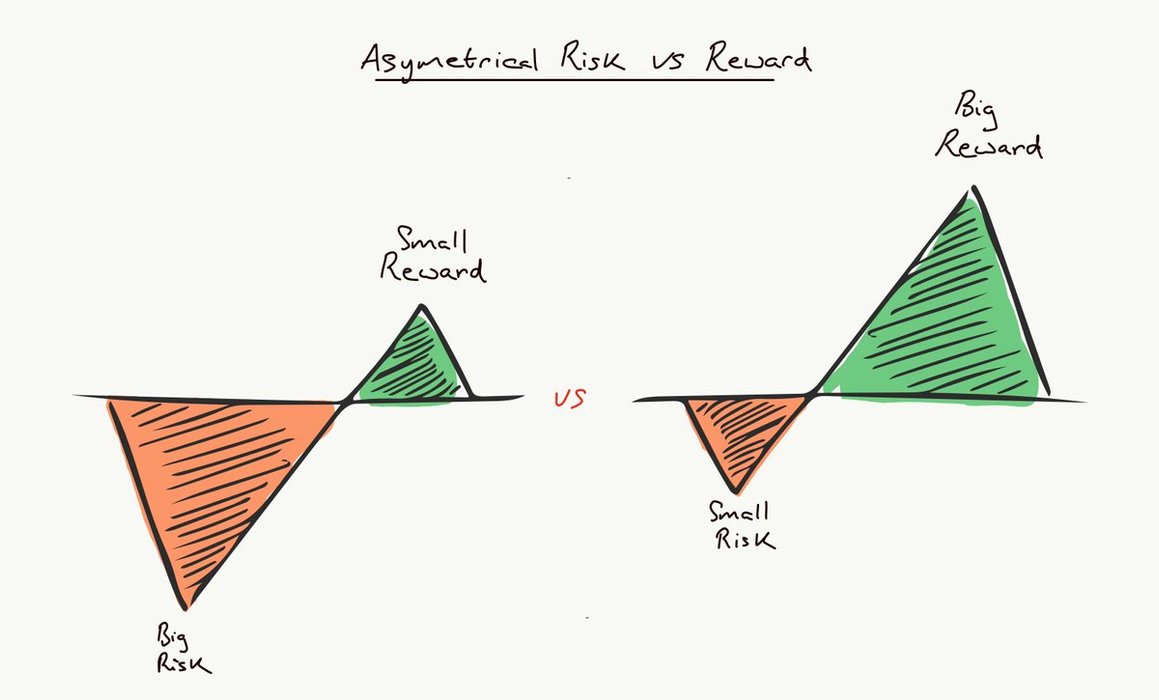

if i had to summarize great investing in a single word, it would be “asymmetry.”

seek opportunities where the possibility of gains wildly outweighs what you can lose, which is typically capped at 1x your investment.

you’re not playing for a 1.5x or 2.0x outcome, you could be playing for a 10x, 20x, or even 100x outcome.

A concept I learned at 28 I wish I learned at 18.

Asymmetric Opportunity: https://t.co/qQUjMIGhtk

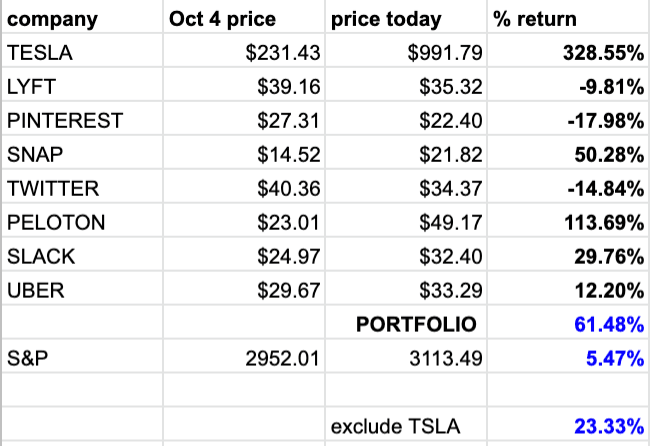

i just ran the math on this

if you had taken a long position in all of the public companies he was bearish on, you would have returned 61.48% (vs S&P 5.47%).

even if you exclude TSLA, you would've returned 23.33% https://t.co/ph4WqXveWy

If you put in 1/3rd of your net worth in bitcoin here you lose 13% if we go to $10k and double your net worth if we go to all time highs

Pretty solid asymmetric bet

TradeButWhyx.com

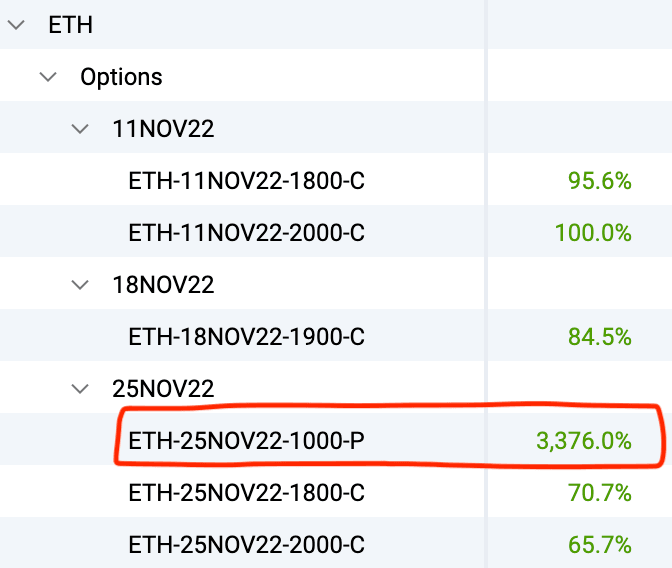

How I used options to hedge the FTX implosion making 3376%🤯 on the trade (even before Arthur Hayes👑)

and how YOU can use them to protect yourself against black swans🦢 events

🧵 on option basics and execution https://t.co/JXyiXXlF1K

3 minute masterclass on the only "free lunch" in finance.

Taught at MIT by Jake Xia,

With no student debt needed. https://t.co/oZyfHSzZ5R

Goshawk Tradesx.comFun graphic on $META from the Rowan Street annual letter (a hedge fund that printed a 102.6% net return in 2023): Shows how non-linear the path to good returns can be and how conviction pays off. https://t.co/jWQGVSc7LS pic.twitter.com/scq24Mjkzc

Michael Dempseyx.comGetting some questions from people who are where I was at the beginning of last cycle. Here are some things I'd recommend.

Some of the rules from my last post still apply, especially the "shaving off a % of a position after euphorically sharing a screenshot of it"

Spoiler alert, the most... See more

DeeZe ⛳🏌️♂️x.com