Sublime

An inspiration engine for ideas

*apologies for the mega tweet, each section was too big to fit into like the replies at the bottom lmao idk, formatting may be shit too :( *

-----------------------------------------------------------

so, some thoughts about the recent trading competition where i turned $2,000 - $775,000 in... See more

requisiemx.comWatching everyone play musical chairs in the trenches and stuck on where to start? 🤔

Here is a quick thread of tips and tricks I'm using personally.

1) You need a trading bot, using jupiter/birdeye/dexscreener isn't going to cut it during periods of high volatility where speed is of the... See more

DeeZe ⛳🏌️♂️x.comThere are certain heuristics that work in PvP market conditions that don’t apply as much in PvE market conditions

- The most obvious is fading high funding/up only price action. In bull markets funding can stay higher than shorts can remain solvent

- The second is the need to rotate. Understand that new... See more

Andrew Kangx.comTherefore, a trading strategy is less important than a trading character. What matters is the consistent approach that they are all taking and the love for trading that they share.

Atanas Matov • The Quiet Trader: Philosophical Guide to Profitable Trading- 240 Meditations

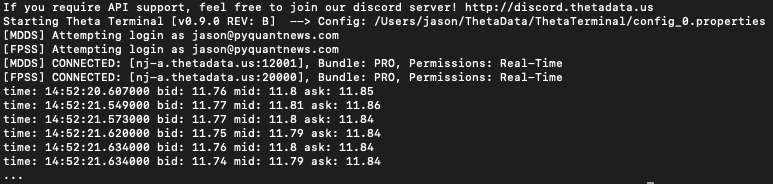

The NUMBER 1 issue for options traders:

Data.

I spent $1,125 on historic data for 1 symbol.

I wasted months scraping the CBOE website.

I lost money using 20-minute delayed data from... See more