M&A

New Deal Checklist - Andy Vandenberg (Twitter)

docs.google.com

New Deal Checklist

Setting values/metrics/criteria for deals

Ranking/Priorities

Sourcing

Indemnification: What Exactly Is a Seller Responsible for When Selling Its Business? | Middle Market Growth

Paul Pincus, Esq.middlemarketgrowth.org

LMM M&A - Selling business, liability around reps & warranties, indemnification.

$20mm and under - not common.

The Ultimate US Entrepreneurship Through Acquisition (ETA) Investor and Accelerator Directory

Dairis Zarinsskarp.ai

Ultimate ETA Directory of Investors, Support, Equity and Debt providers

Search fund investors, family offices and more

About us - Snowball

snowballclub.com

SMB owners sharing deal flow, questions and concerns within the broader acquisition and operating spaces.

Working Capital in Small Business Acquisitions: Insights from Industry Experts

Roman Beylinduedilio.com

Working Capital for Deals

Examples, different cases

Solutions

PE moving from LPs to bring inhouse on investments to be able to draw capital whenever they want - Blackstone / Berkshire with access off the balance sheet on permanent capital.

Interesting that as PE has been open to 401k individual investors, it has also become more opaque as governance will typically lack without the intermediary relationship of GP/LPs.

Decada Group - Utah Holdco (stumbled onto it from Michael Girdley’s newsletter)

Community-based holdings, acquisitions and growth around building forever

Fundscout - Fundraising-as-a-service with AI

fundscout.ai

Sourcing Debt / Equity

Fundraising

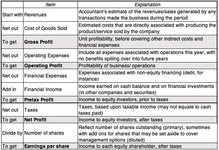

Value and Profitability - Damodaran 2025 Exploration into Sectors and levels of Profitability