fundamental analysis

Finding ownership stakesLearning how much a company's insiders own can be done quickly by looking up the company’s DEF 14A filing with the Securities and Exchange Commission (SEC).You can do this by searching the company’s filings via the SEC’s database or a company’s investor relations site.Once the DEF 14A has been located, searching the document... See more

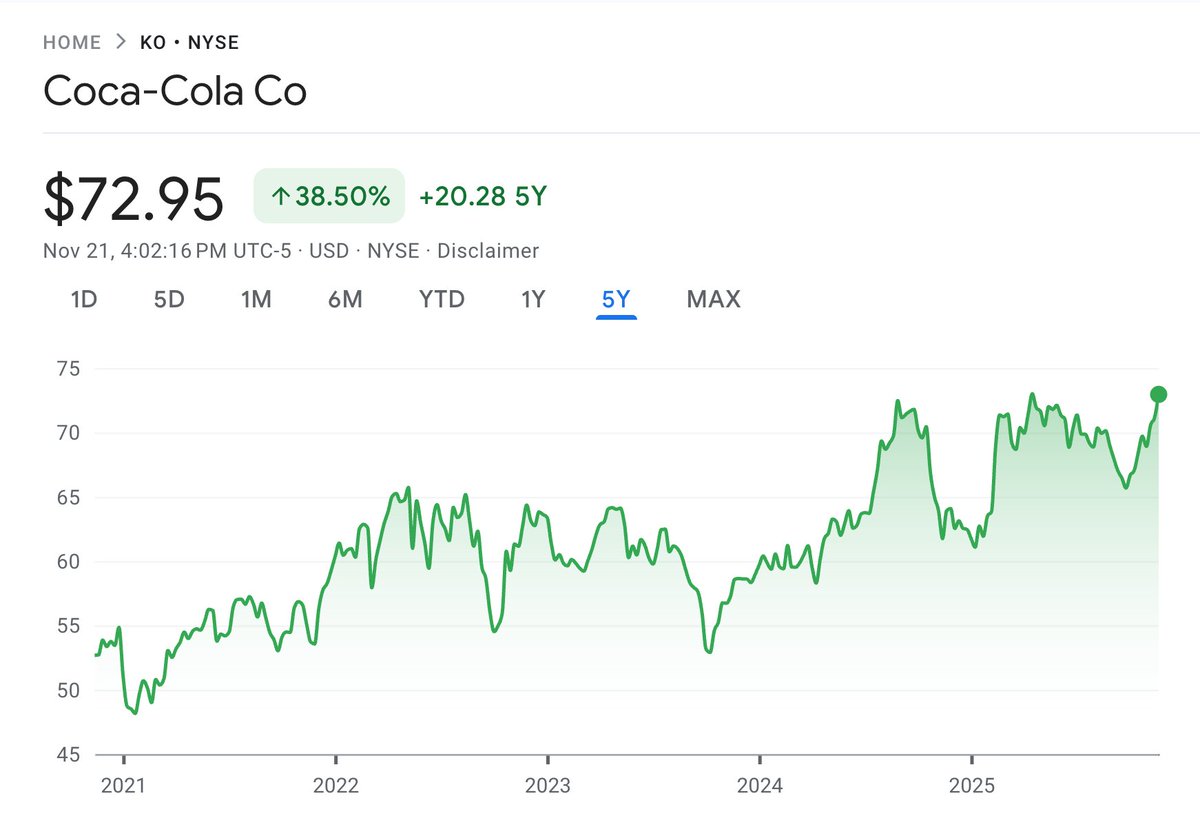

Stocks that double within five years and then drop 30% in a month are generally best avoided, as such sharp declines often indicate serious underlying issues.

Reader

he uses what I think is the terminal growth we use in the rDFC i.e. economy growth plus inflation that takes it to sort of 4% conservative

Stock Investing Mentor

The research emphasizes comparing returns relative to industry peers to avoid sector bias, confirming that broken compounders underperform their sector averages by about 10% over the following year.

Reader

Market valuation metrics like P/E ratios have limited predictive power over short-term (1-3 years) market performance, with long-term context (15-20 years) being more relevant for understanding trends.

Historical S&P 500 forward earnings multiples have ranged dramatically, from as high as 22 to as low as 9, indicating that valuation alone is not a... See more

Historical S&P 500 forward earnings multiples have ranged dramatically, from as high as 22 to as low as 9, indicating that valuation alone is not a... See more

Reader

Today, a community member reached out after running a DCF on Coca-Cola and asked, half-shocked:

“Could $KO really be this overvalued?!”

(The intrinsic value estimate was around $20 vs. the current price of $73)

And honestly, that reaction is completely normal when someone... See more