Broadway Unlocked

Ideas that help bridge the traditional Broadway ecosystem and a new digital model that scales theatrical storytelling across multiple platforms — social media, podcasts, streaming services, subscriptions and beyond.

Broadway Unlocked

Ideas that help bridge the traditional Broadway ecosystem and a new digital model that scales theatrical storytelling across multiple platforms — social media, podcasts, streaming services, subscriptions and beyond.

Hollywood used to be run by folks that understood that a successful film, or character, or auteur is more than first weekend box office revenue — it is the most valuable asset ever, that is built over time and lasts for decades. Bob Evans was driven by taste and instinct, and used capital to back people, repeatedly — Coppola, Polanski, Friedkin — not just “big IP”. He understood that cultural value compounds around unique voices in ways financial models can’t predict.

The service is currently available to about 10,000 libraries, or 40 percent of North America’s libraries, as well as about half of high-end colleges in the country. Kanopy houses roughly 35,000 titles with 150 more coming each week. Some standouts on the service include newer films like “Moonlight” and “Lady Bird,” as well as older classics like “Rashomon” and “Chinatown.”

Gavin puts the current state of FAST in perspective: Crowded. Fragmented. Very good for aggregators. Less good for channel publishers.

The scale of differentiation necessary to produce an MVIP has historically been determined based on the past behavior and preferences of demand. People liked to consume IP via books, movies, TV shows and comic books, not via an outline, or a few chapters, or a single picture.

Now, however, the disruption of traditional IP distributors via streaming and social media networks allows IP owner to have more flexibility in terms of production and distribution.

Lil Nas X, for example, is able to distribute his music (his IP) instantly by publishing a song (‘Old Town Road’) on SoundCloud and have it explode in popularity via remixing and UGC on TikTok. Previously, he would have had to wait to be discovered by a record label, who then would decide when to release his music and in what form factor — most likely as an album rather than a single.

Unified Video Strategy and Ad Revenue analytics

More broadly, many OnlyFans creators now treat sites such as Reddit, Imgur, Instagram, TikTok, and Twitter as “front doors” for OnlyFans customer acquisition.

Also: [As an aside: OnlyFans 80% revenue share rate is practical only because it does not offer App Store-based billing (which would take 15-30% of revenue off the top). In fact, neither iOS App Store nor Google’s Play Store even allow for pornographic apps. Usually, such a ban would destroy a media platforms’ business model, but browser-based experiences are fine for viewing photos and videos and sending messages (in contrast, most games can’t even run). And while apps tend to offer better user experiences and far simpler payment processes, most OnlyFans customers aren’t dissuaded by the need to use a browser, nor the extra hoops involved in manually entering a credit card number (again, this is less true for casual games or ecommerce).]

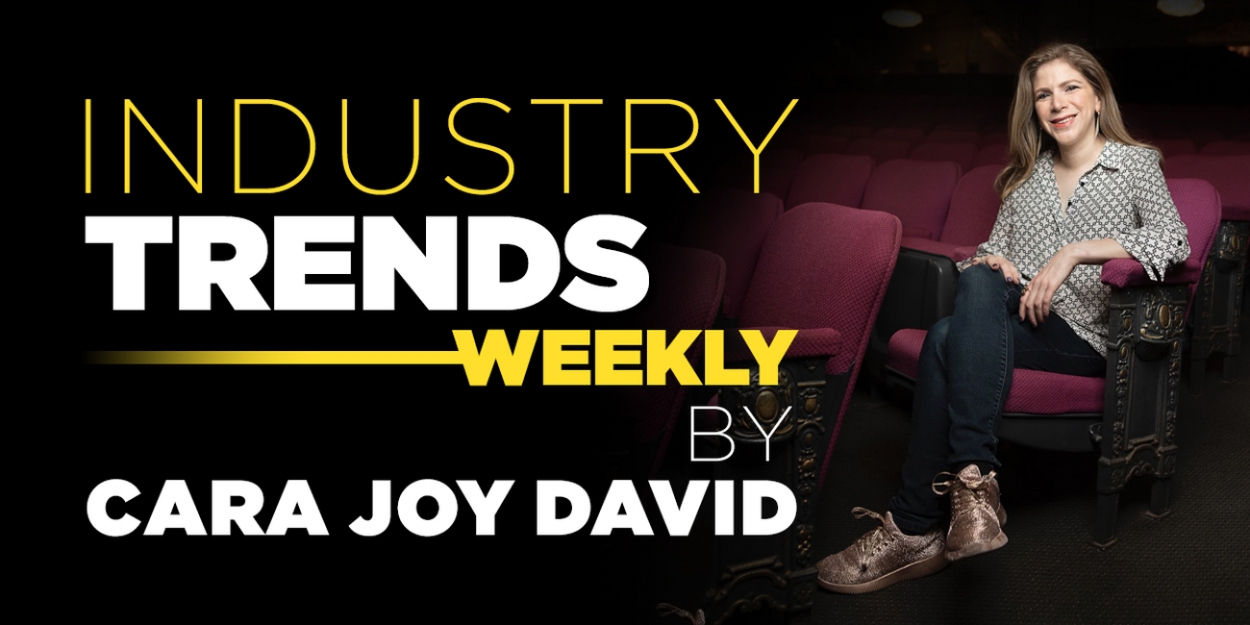

To minimize churn, many benefits (e.g. back catalogues) are only available to long-running subscribers.

“The League doesn’t ask patrons to rank the primary driver in their ticket purchase. (Individual shows sometimes do in their own research surveys. I’ve heard various figures from producers throughout the years—and most are similar to what I found. Though it has varied to a certain extent show to show.) That’s what I asked of people—what truly drove their purchase. I went to musicals as well as plays from last spring to this fall; I did not poll at any show running over two years. For Shucked, a show that several people told me greatly benefited from influencers, I spoke to twenty people during previews and then another fifteen people later in the run. In total, two of 200 people I spoke to said an influencer was the primary reason they purchased a ticket. Both of those people were under 30. Several others had seen influencer content, but that content was not the primary reason they purchased tickets. (Source material, stars, personal recommendations, and press topped the reasons; show specific obviously.)

There are likely many reasons that influencers are not driving ticket sales. According to the League, last season the average theatergoer was 40.4 years old, older than the typical influencer target. Theater tickets are generally expensive, so it may take more than one person’s word to take the plunge and buy. But, additionally, most influencers that push theater consistently are so-called "theater influencers" and primarily have their content pushed to theater fans.”