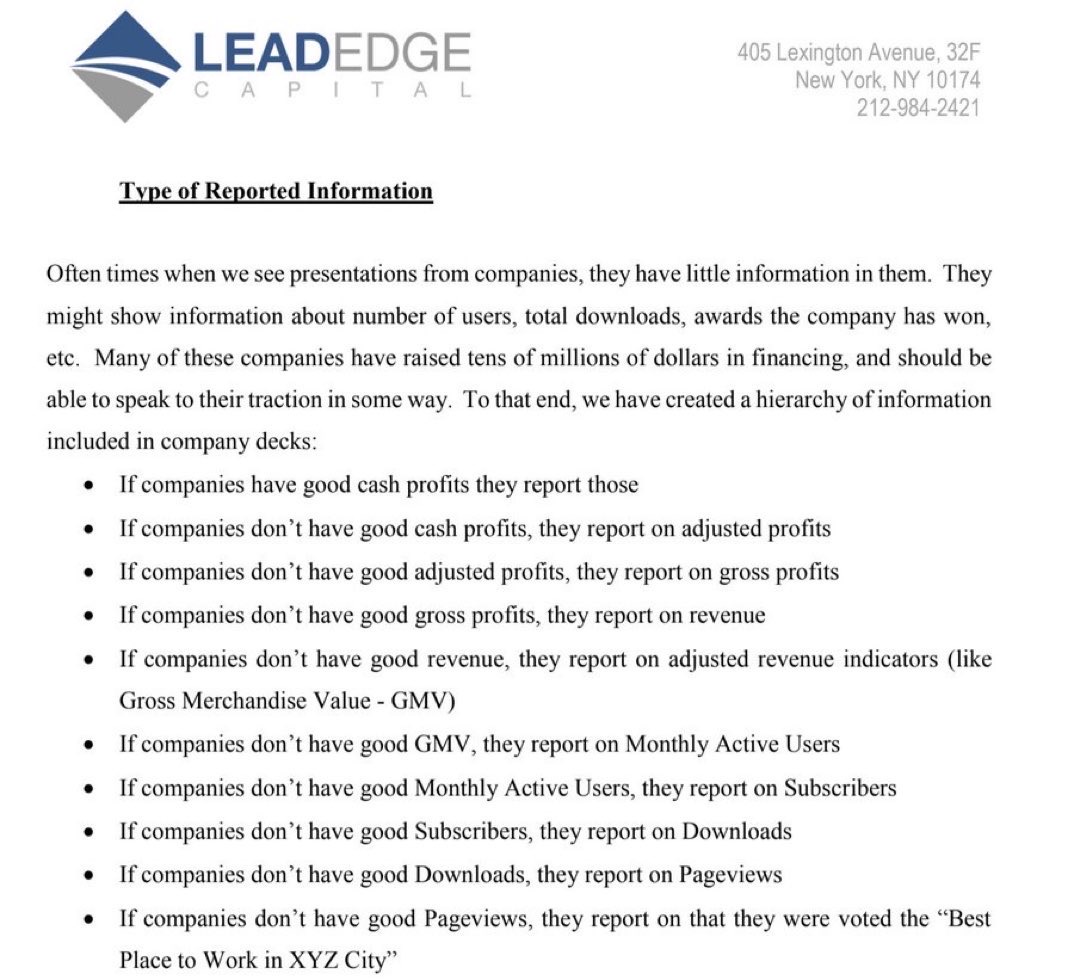

This remains one of my favorite investor notes of all time. Thanks @LeadEdgeCapital. https://t.co/wAt5tJAlZV

I'm seeing more founders put together "investment memos" as fundraising material. It's a good idea.

But too many of them read like book report summaries.

Founders if you are going to write a memo, make sure it reads like a thesis:

1) How you developed your... See more

Mercedes Bentx.comOne of the bravest and most disciplined companies I’ve worked with sent investor updates every month with “$0 revenue” at the very top.

They sent it consistently every month for more than an year and never made excuses. They said “this isn’t good enough and here’s what we’re doing to try to change... See more

Tom Blomfieldx.com