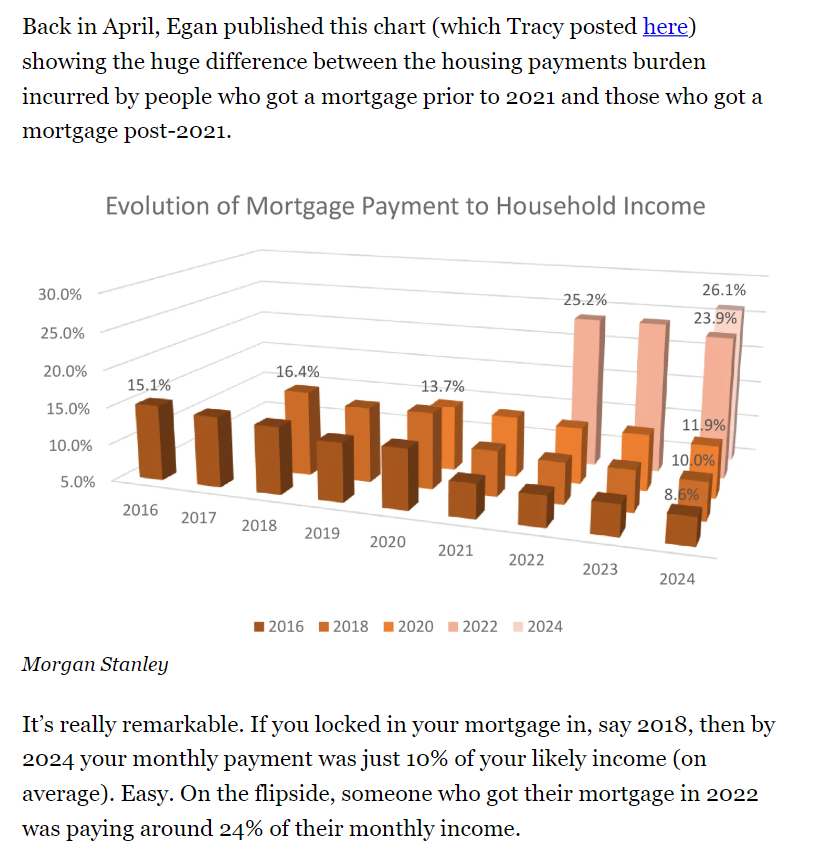

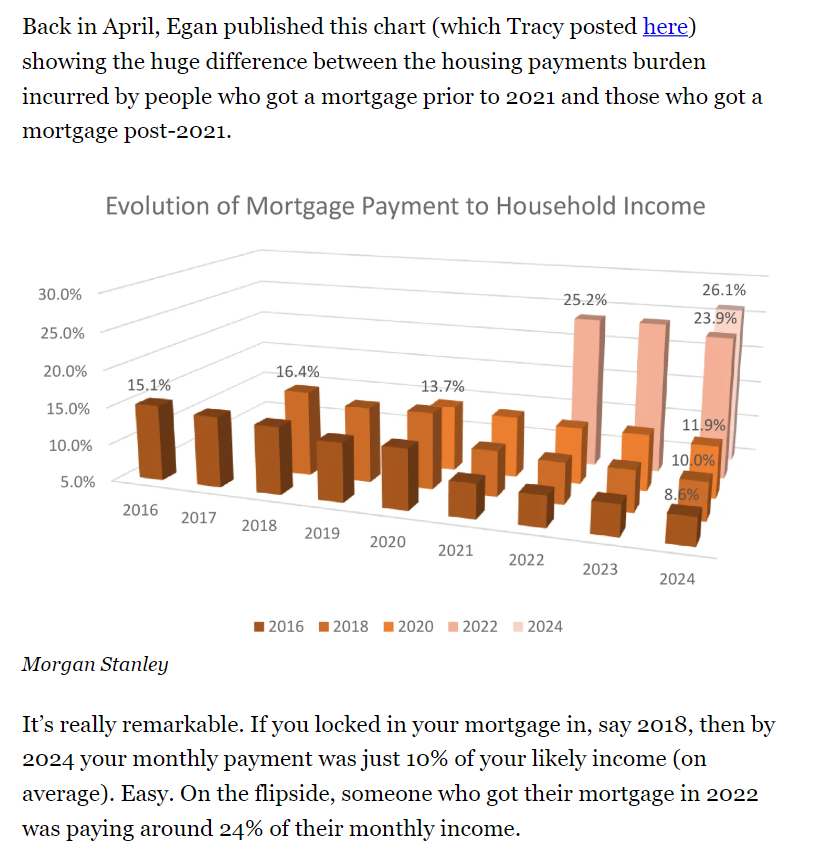

This one chart from today's podcast guest Jim Egan. Incredible.

The difference between having a ZIRP-era mortgage and not having one. https://t.co/o71SYqgz7s

This one chart from today's podcast guest Jim Egan. Incredible. The difference between having a ZIRP-era mortgage and not having one. https://t.co/o71SYqgz7s

Basically, if someone went into these past couple of years owning a house with a low fixed-rate mortgage, a portfolio of financial assets, and decent income, then they’re probably feeling pretty okay right now, economically speaking. However, those who didn’t manage to get a house before mortgage rates rose sharply, and/or who don’t have a lot of

... See more