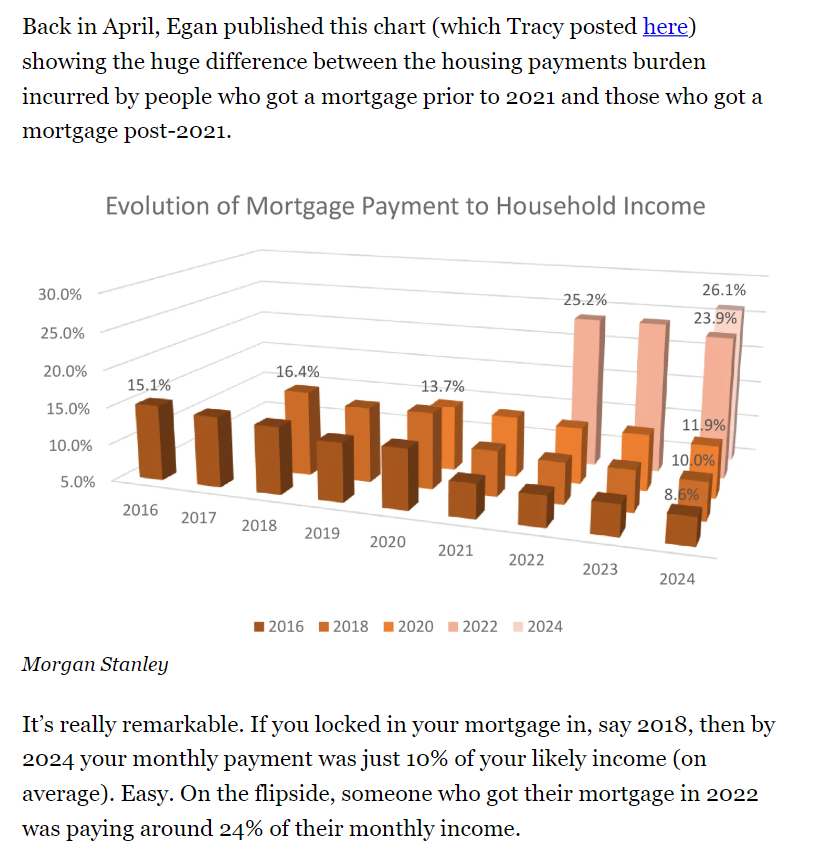

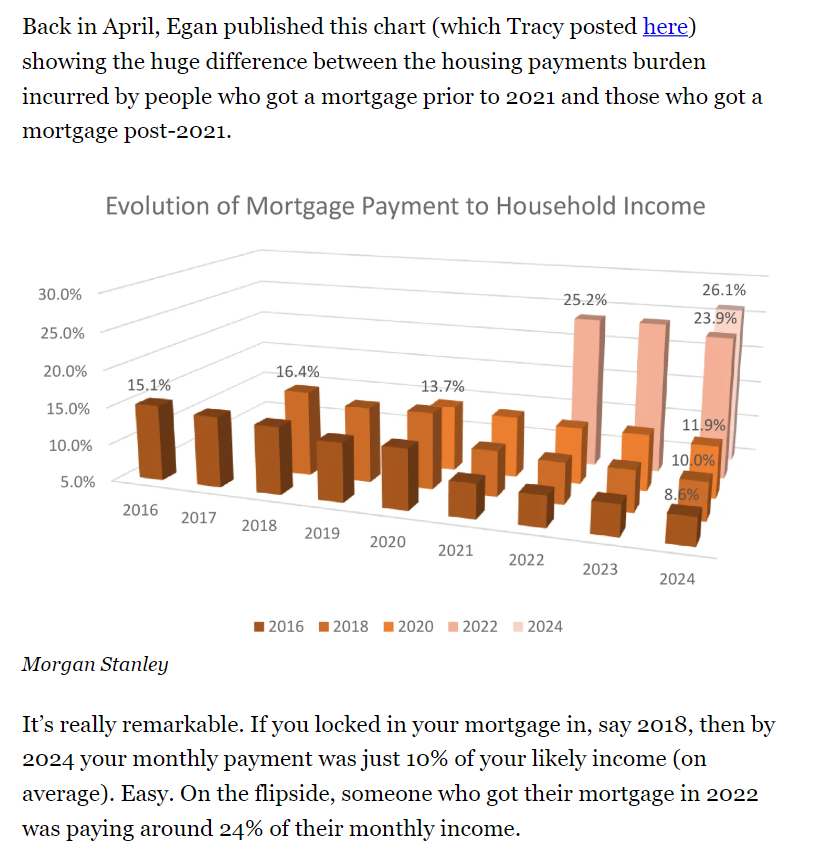

This one chart from today's podcast guest Jim Egan. Incredible. The difference between having a ZIRP-era mortgage and not having one. https://t.co/o71SYqgz7s

Basically, if someone went into these past couple of years owning a house with a low fixed-rate mortgage, a portfolio of financial assets, and decent income, then they’re probably feeling pretty okay right now, economically speaking. However, those who didn’t manage to get a house before mortgage rates rose sharply, and/or who don’t have a lot of

... See moreLyn Alden • Deep Dive: Emerging Markets

Michael Howell • The Debt-Liquidity Spiral

Economists’ preference for adjustable-rate mortgages versus fixed-rate, focusing on inflation risk, real payment burden, and volatility.

TRANSCRIPT

In his paper, the explanation was fairly complicated. It is complicated. The reason that popular authors strongly recommend fixed rate mortgages is that they sound very safe. You have a fixed monthly payment. What could be safer than that?

Now, the hidden risk in fixed rate mortgages lies with the inflation rate. So you take off the mortgage.

... See more