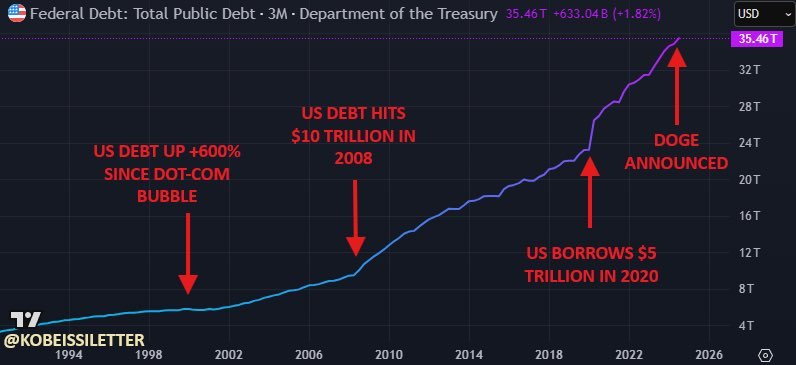

The story going into FOMC tomorrow: The Fed needs to lower rates because the US needs to roll over $8-9 trillion of debt in 2025.

Rolling over $8-9 trillion at 2025’s higher rates (e.g., 4-5% vs. 1-2% pre-2022) increases interest expenses, projected at $1.1 trillion for 2024

MartyPartyx.comThe story going into FOMC tomorrow: The Fed needs to lower rates because the US needs to roll over $8-9 trillion of debt in 2025. Rolling over $8-9 trillion at 2025’s higher rates (e.g., 4-5% vs. 1-2% pre-2022) increases interest expenses, projected at $1.1 trillion for 2024

"The Federal Government today pays more in interest on the debt than we do in budget for the Department of Defense. We pay $1.2B a year in JUST interest on debt. Total government spending is about $7T. Interest payments are $1.2T. DOD is $800B a year. Total debt is $35T and it adds another $1T of debt every 100 days."

Tesla Owners Silicon Valleyx.comOf all the issues the US is dealing with, there is one issue bigger than all others combined and it’s the one outlined by Stan Druckenmiller below.

Wars are terrible. Inflation is terrible. Illegal immigration is terrible. But debt is a crippling, multi-generational yoke.

The United States... See more

Chamath Palihapitiyax.com

How can any American believe this trajectory is sustainable? https://t.co/6DD2CR5DiF