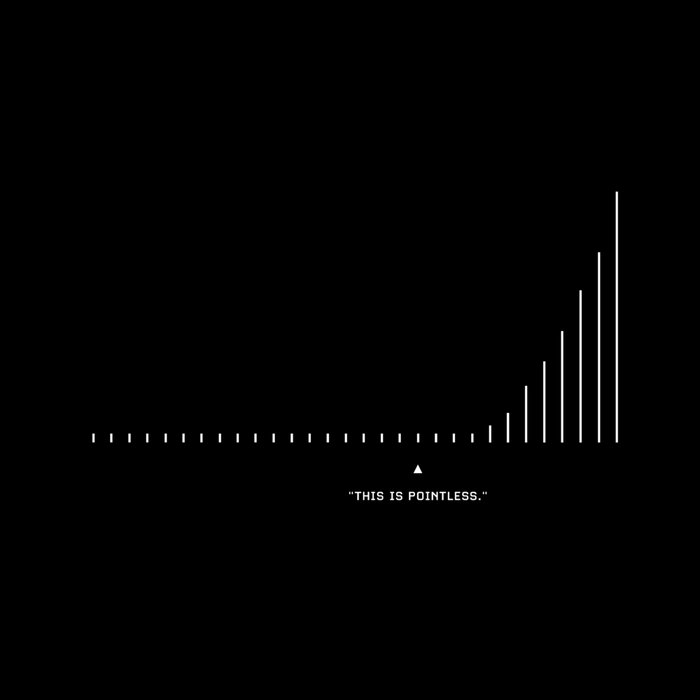

easy to be bearish crypto right now we’re fifteen years in we’ve spent enormous energy trying to build valuable stuff on top of trust-minimized technology the results feel underwhelming - many tokens - few products with global impact - asset markets that reward local attention over durable value ^ this view notwithstanding i think a large part of what feels broken is pretty close to being solved not by technology i think we’ve got all the raw material we need for crypto to dominate the last piece is harmonization between value created (products) and value accrued (token) and i think we’re getting pretty close there are roughly two categories of tokens > tokens that are money (ex. stores of value) > tokens that make money (ex. productive assets) i think the money tokens (BTC, ETH, SOL, etc) are better understood and further along in their adoption so i won’t explore these ‘are money' tokens in this thread the piece that actually feels broken to me the one we (as an industry) just quite can’t get over the hump on are the ‘make money’ tokens take public equities for example public equity assets get priced because markets can: - verify revenue - verify expenses - guarantee value accrual historically, this type of underwriting has lagged across crypto > crypto revenue for crypto projects with tokens, we’ve got two types of revenue: onchain revenue; and offchain revenue onchain revenue is legible by default. AMM fees, sequencer revenue, bridge fees, etc everyone sees the same dashboards it’s all public, scrapable, and can be modeled in real time super cool but while that transparency is a feature, it’s also somewhat noisy, as onchain activity functions like a billboard projects in crypto have been trained to: (1) build for what is easily measurable; and/or (2) broadcast what is temporally beneficial wash trading, incentive-driven volume, liquidity mining, and farming mechanics can inflate top-line metrics without producing recurring demand over periods investors end up underrating, overrating, or misclassifying revenue quality separately offchain revenue has a slightly different problem some crypto projects with tokens also run centralized infra, generating higher quality revenue offchain but almost none of it is verifiable both paths leave room for improvement: - onchain revenue is transparent, but noisy and gameable - offchain revenue may be easier to generate for some crypto projects, but opaque and structurally unverifiable unlike equities, there are no real standards to adhere to which makes underwriting difficult > crypto expenses like revenue, crypto projects with tokens often have two flavors of expenses onchain expenses; and offchain expenses onchain expenses are easy to track and model, but because they’re public and often reported casually, onchain totals become a weak snapshot for the true cost of sustaining a product onchain offchain expenses are real-world operating costs that are mostly opaque and often dominate the cost structure, including engineering and research salaries, cloud infra, legal and compliance spend, security, marketing, general ops these expenses determine whether a project is actually scalable or profitable, yet are rarely disclosed with real accounting rigor again, no standards to adhere to which also makes underwriting difficult > crypto token value accrual in equity markets, assets accrue value through legally enforceable rights, including claims on residual cash flows, dividends / buybacks, voting, and priority in liquidation or acquisition events these rights are standardized, disclosed, and protected by law, which allows markets to underwrite future cash flows and price equities based on expected value in crypto, this is where things really start to break down at the fundraising stage, teams face an array of optionality: - build for equity value - build for token value - build for both with no clear guidance in the U.S. on how tokens accrue traditional value (while simultaneously acknowledging that tokens are the asset that can best power labor and productivity over decentralized networks) projects historically have raised on both SAFEs (equity) and warrants (network) this creates a capital stack where value accrual is left ambiguous across competing instruments, out of survival - teams preserve flexibility - investors underwrite both paths then the TGE happens, and there is only one brutal question left -- what is this token actually allowed to do? - is it a security or a commodity? - can it capture fees? - can it receive distributions? - can it be bought back and burned? in the absence of legal guideposts, the majority of teams choose inaction the token exists as a coordination incentive, but enjoy no real claim on value created and the network never fully matures here’s a common pattern: > team raises money on SAFE (equity) and Warrant (token) > team builds technology > team launches token > team delays value accrual to the token because acting feels legally ambiguous (at best) and legally dangerous (at worst) > team gets tired of waiting around for answers > team runs out of money or gets acquihired (equity) > the foundation commits to maintaining network in perpetuity (token) > network is no longer as competitive feels pretty clear to me until network tokens are explicitly allowed to return value through defined mechanisms that take into account their unique digital shape on the internet as both (1) labor incentives; and (2) direct connection to network revenue then: > value accrual to tokens will remain fragile and discretionary > markets will continue to misprice them > risk capital will mostly remain uninterested in them > innovators in the US will mostly remain uninterested in building networks powered by them that brings us to today the US has historically set the regulatory standards that global capital, companies, and markets adopt by default clear crypto rules in the US will effectively become the reference framework for the rest of the world in the US, we have a rare opportunity to shape how token-based capital formation, disclosures, and value accrual work globally rather than ceding those standards to others thankfully i think things are starting to change and so i tend to believe the next phase of crypto tokens will be built on the back of US legislative and regulatory leadership where we create a verifiable trail from network revenue to token holder that is defined, repeatable, and legally durable at all stages of a network’s life the market is clearly looking to solve a number of these problems recent efforts from individual crypto projects are providing leadership on different problem areas, with a few of these approaches listed below: - at fundraising stage, moving to new unified instrument models (e.g. @colosseum STAMP) - pre-TGE unification across equity/tokens (e.g. @rainbowdotme Class F) - post-TGE unification across equity/tokens (e.g. @UniswapFND UNIfication) - public token disclosure frameworks (e.g. @Blockworks_ Token Transparency Framework) importantly, there are also a number of concurrent efforts led by US legislators (Congress) and regulators (SEC/CFTC), including the clarity act, the SEC’s rulemaking authority re: token safe harbors, the stablecoin / market structure bills, among other federal agencies and initiatives and while these regulatory/legislative efforts are only building blocks today, i tend to believe the net of these US efforts will converge and lead to the following over the coming years: - better auditing of on/offchain pathways to track and manage network operations - create "minimum viable disclosure" standards for projects launching network tokens - harmonization across SEC/CFTC on classifying tokens as "commodity" vs "security" at different stages of a network's life - allow early stage crypto networks to have a compliant time-limited safe harbor to launch tokens, disclose material information to public, and create new business models with tokens before final classifications apply and so, from my view, the endgame for the “make money” tokens is just about getting back to the basics combine: > a project’s verifiable on/offchain activity; with > explicit value accrual and legal rights for their token; > all within a coherent regulatory framework in the US and as that happens global risk capital, from individuals to institutional allocators, won’t need to underwrite a new belief system on value accrual to participate in these global networks for the first time they can use the same frameworks that already work and for me i think that’s a pretty healthy evolution for this specific category of tokens (crypto art by @jackbutcher)

> tokens that are money (ex. stores of value)

> tokens that make money (ex. productive assets)

i think the money tokens (BTC, ETH, SOL, etc) are better understood and further along in their adoption

so i won’t explore these ‘are money' tokens in this thread

the piece that actually feels broken to me

the... See more