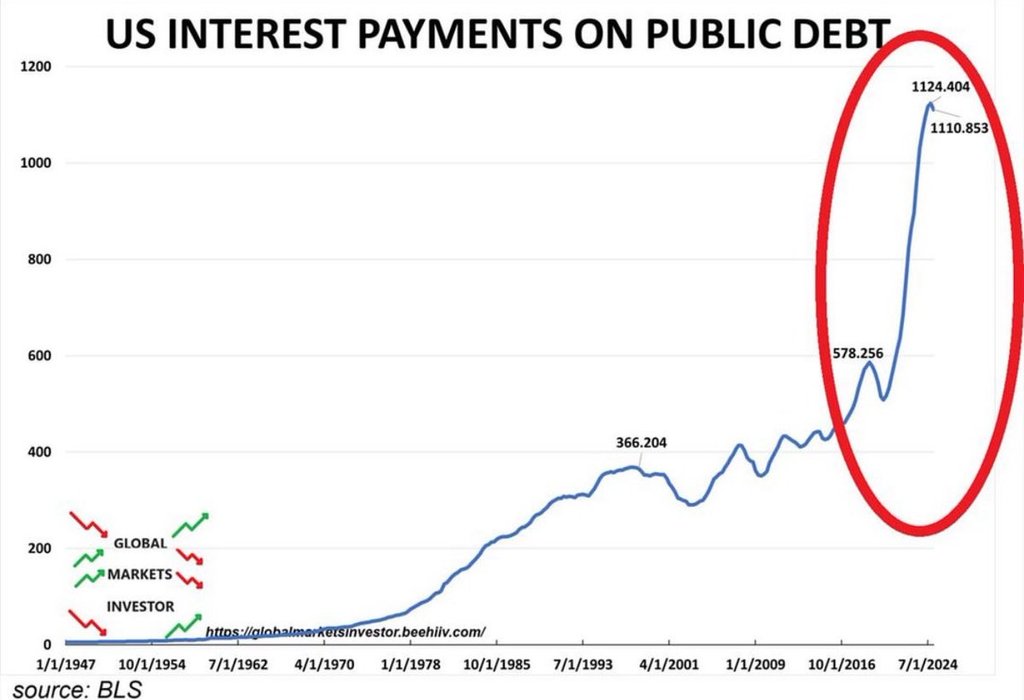

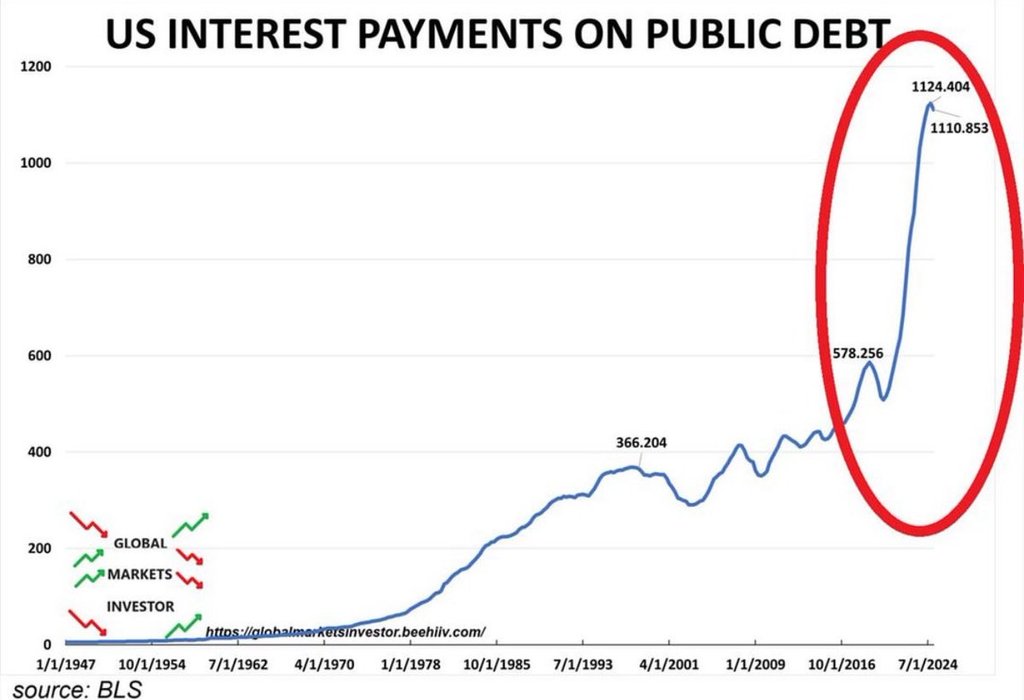

Debt Bombshell: U.S. Interest Payments Soar to $1.1 Trillion in Q1, Devouring 35% of Tax Revenue, Exceeding National Defense Spending. https://t.co/RP6i9KT6rV

Debt Bombshell: U.S. Interest Payments Soar to $1.1 Trillion in Q1, Devouring 35% of Tax Revenue, Exceeding National Defense Spending. https://t.co/RP6i9KT6rV

In the United States, we ran up unfunded pension deficits at many local and state funds, to the tune of $3 to $4 trillion and rising. We have a massive (multiple tens of trillions of dollars) bill coming due for Social Security and Medicare, starting in the next 5 to 7 years, that makes the current fiscal crisis pale in comparison.

Every year in the United States, we spend more than $10 billion on church buildings. In America alone, the amount of real estate owned by institutional churches is worth over $230 billion.