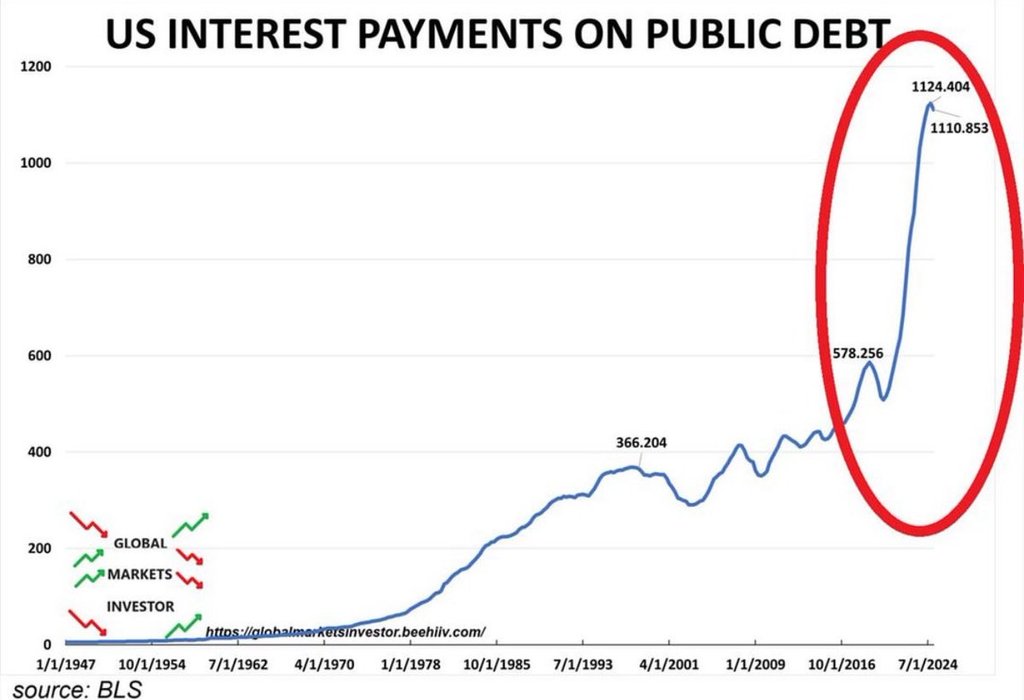

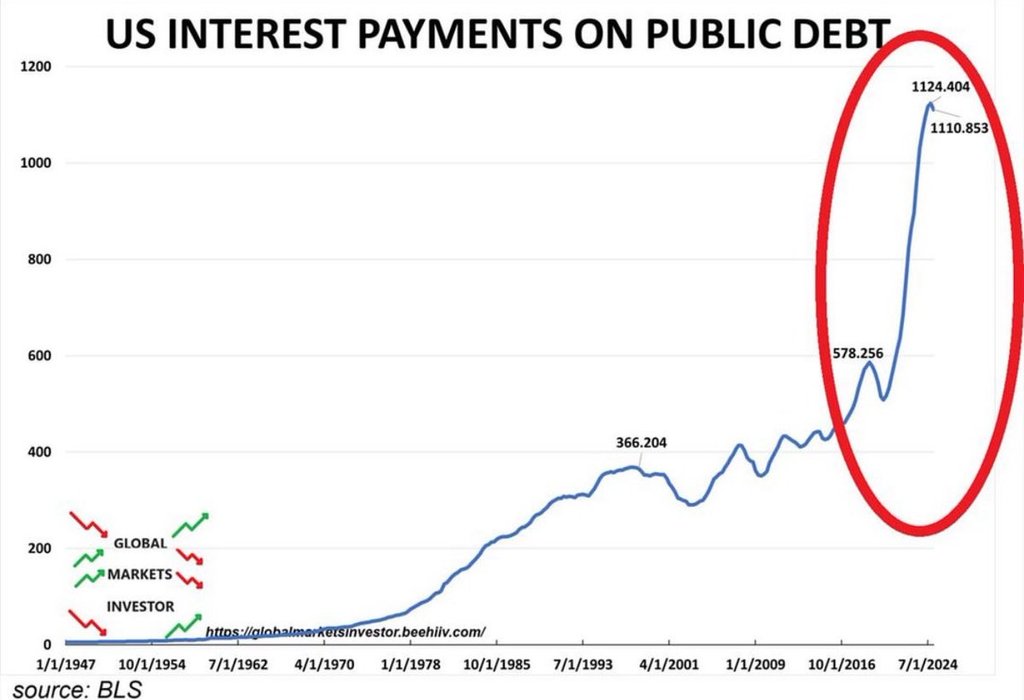

Debt Bombshell: U.S. Interest Payments Soar to $1.1 Trillion in Q1, Devouring 35% of Tax Revenue, Exceeding National Defense Spending. https://t.co/RP6i9KT6rV

Debt Bombshell: U.S. Interest Payments Soar to $1.1 Trillion in Q1, Devouring 35% of Tax Revenue, Exceeding National Defense Spending. https://t.co/RP6i9KT6rV

While many focus on our rising interest costs to service our rising debt amounts I dont much care. We pay our interest to our citizens. Our existing debt service costs are mostly just a small symptom of the theft. The big thing to worry about is our primary deficit. That has grown far faster than our interest cost. Each year our primary deficit lay

... See more