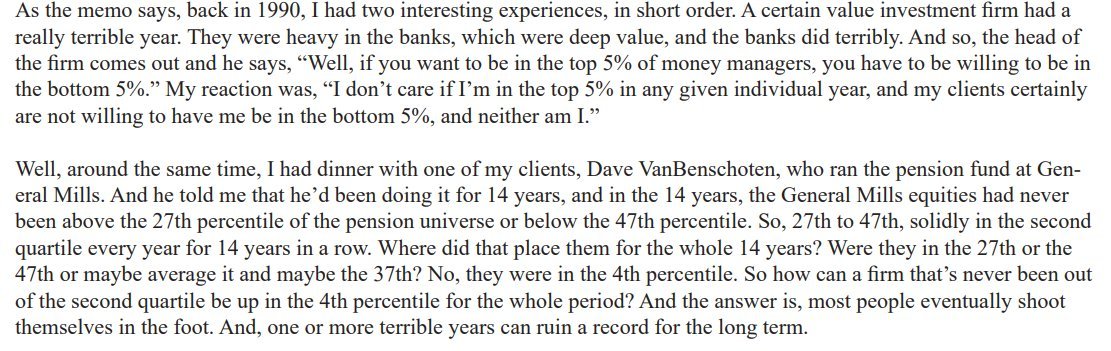

if anyone has difficulty staying patient, this Howard Marks story can help.

(Also, anyone who's up 100% YTD will not come back to inform you that they're down 50% or whatever when/if that happens in some future year.) https://t.co/mlAw0u29Qy

if anyone has difficulty staying patient, this Howard Marks story can help. (Also, anyone who's up 100% YTD will not come back to inform you that they're down 50% or whatever when/if that happens in some future year.) https://t.co/mlAw0u29Qy