What are the Different Stages of Venture?

withvincent.com

What are the Different Stages of Venture?

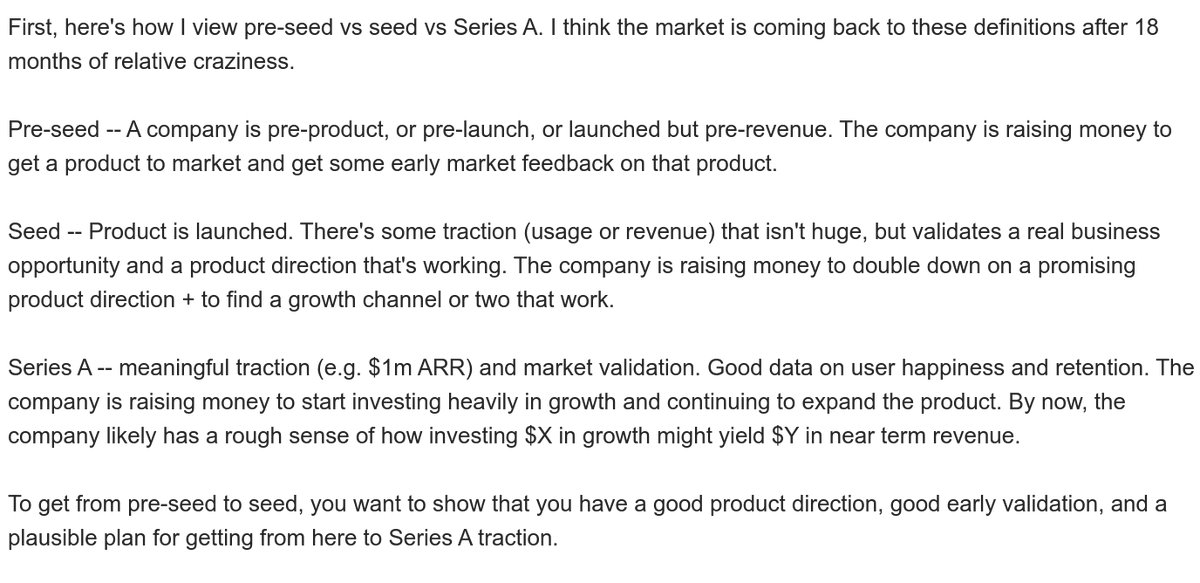

preseed or idea round. Serial entrepreneurs with a proven track record may ask for funding to work on an idea for a product or service, and investors who have worked with these founders before may be willing to put up the money. However, most startup founders will start with a seed round.

Simple Agreement for Future Equity (SAFE)

A SAFE gives investors the rights to purchase stock in a future equity round, often with a specific cap and/or discount. No specific price per share is determined at the time of the initial investment.

They’re a simple and fast way to get early investments into a company. The SAFE was originally

... See more