TS怎么谈,才能在投融资中掌握主动权- 知乎

Questions to ask about your equity:

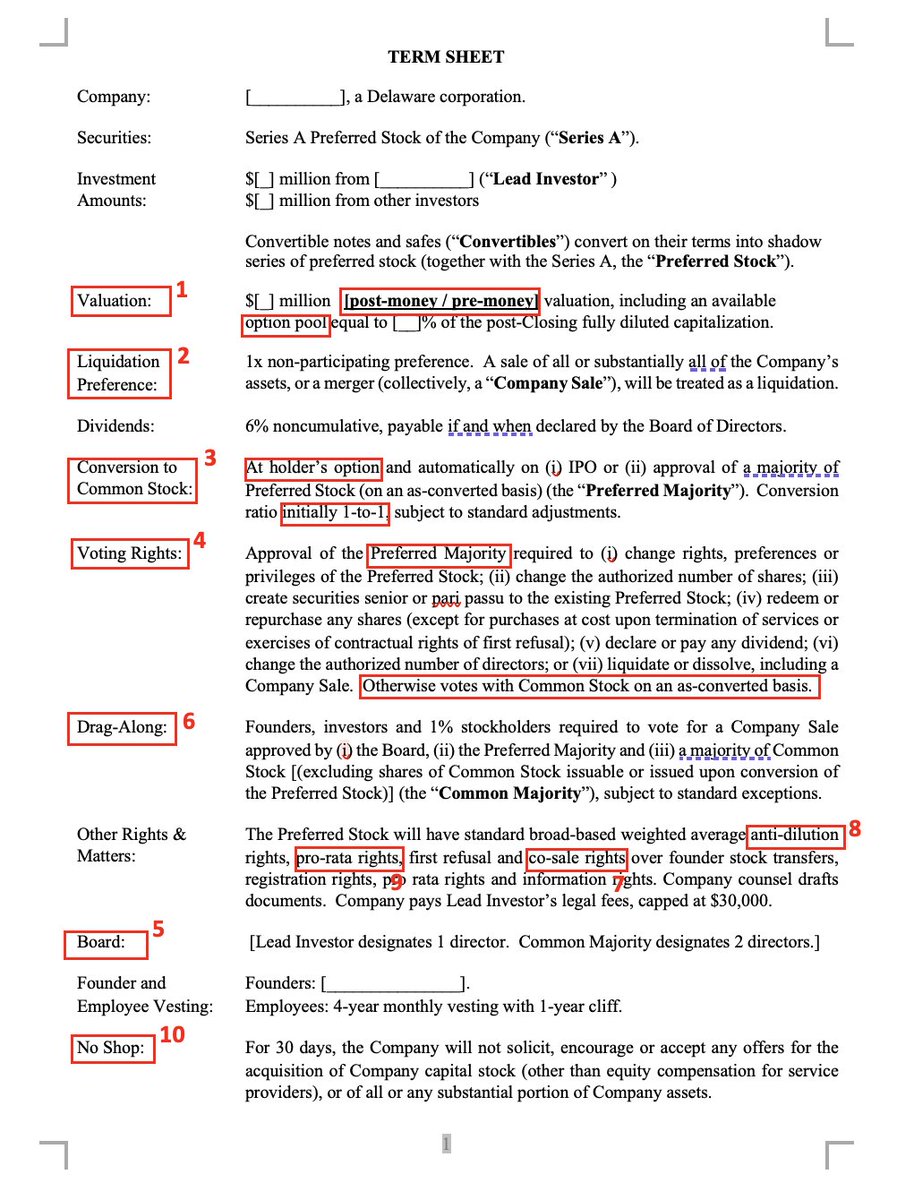

About the round structure: Was it raised at a single price or in tranches? What did the lead pay versus other participants? What percentage of the round came in at the headline valuation?

About your negotiating position: Given valuation risk, can I get more shares? Can I take more cash and less equity? Is early... See more

About the round structure: Was it raised at a single price or in tranches? What did the lead pay versus other participants? What percentage of the round came in at the headline valuation?

About your negotiating position: Given valuation risk, can I get more shares? Can I take more cash and less equity? Is early... See more