The Debt-Liquidity Spiral

This framework gives important insights in a debt-driven World. First-and-foremost, financial markets increasingly operate as vast debt refinancing mechanisms not new capital-raising vehicles . Second, domestic and international capital flows represent key drivers of the economic system. Increasingly cross-border flows determine trade balances, not

... See moreMichael Howell • The Crest of a Wave

A central theme in Howell’s analysis is the assertion that liquidity flows have become crucial in understanding the modern financial landscape. In recent years, particularly since the global financial crisis, the nature of capital investment has evolved. Interest rates, which historically served as a critical indicator of capital allocation, have... See more

The Dynamics of Global Liquidity and Cycles

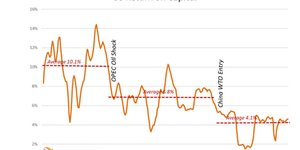

total global liquidity has historically risen and

fallen in these predictable tides of around 5 years this cycle is determined by the average five to six year debt maturity profile that you've spoken about the lows of each cycle nearly always coincide as you've said with some kind of financial crisis and central banks always step in to provide more

... See more