The 2025 Fundraising Guide - Backed by Research, Facts & Figures

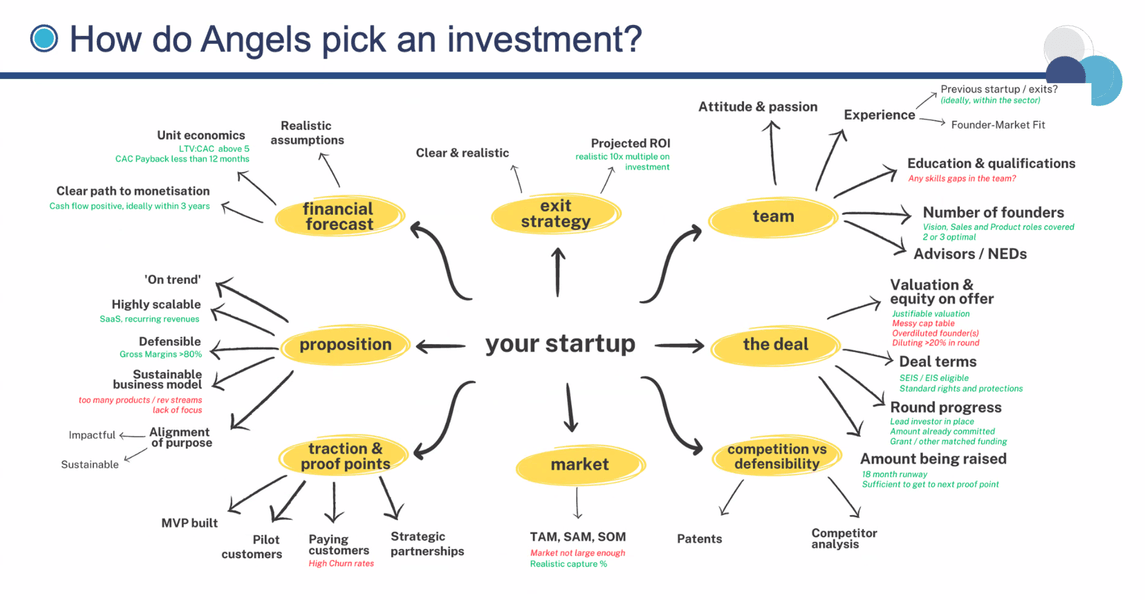

The article provides a comprehensive guide for startup founders on fundraising strategies, emphasizing the evolving capital requirements across different growth stages and the importance of aligning financial goals with investor expectations.

Link

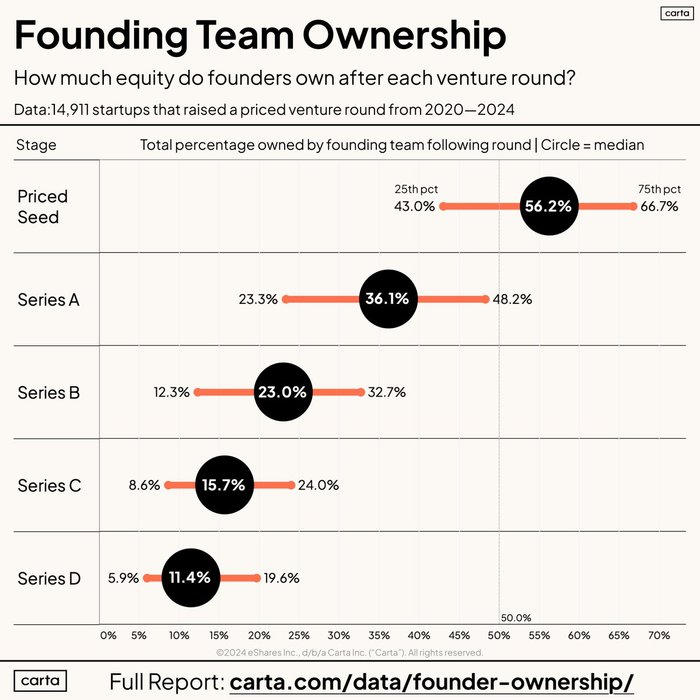

How much do VC-backed founders ACTUALLY OWN of their companies over time?

Might be less than you expect.

The median ownership for the founding team after a Series A sits at 36.1%, according to our study of over 14,000 US startups.

The full report has much more... See more