Risk Capital - Credistick

So if not for the structure, what caused venture’s shift towards such risk-averse investing? As fund sizes grew dramatically and a tech boom spurred a startup surge, the industry's emphasis shifted from discerning selection towards a more diversified 'spray and pray' approach, diluting the value of traditional tasteful investing. When the game of... See more

good artists copy, great artists steal

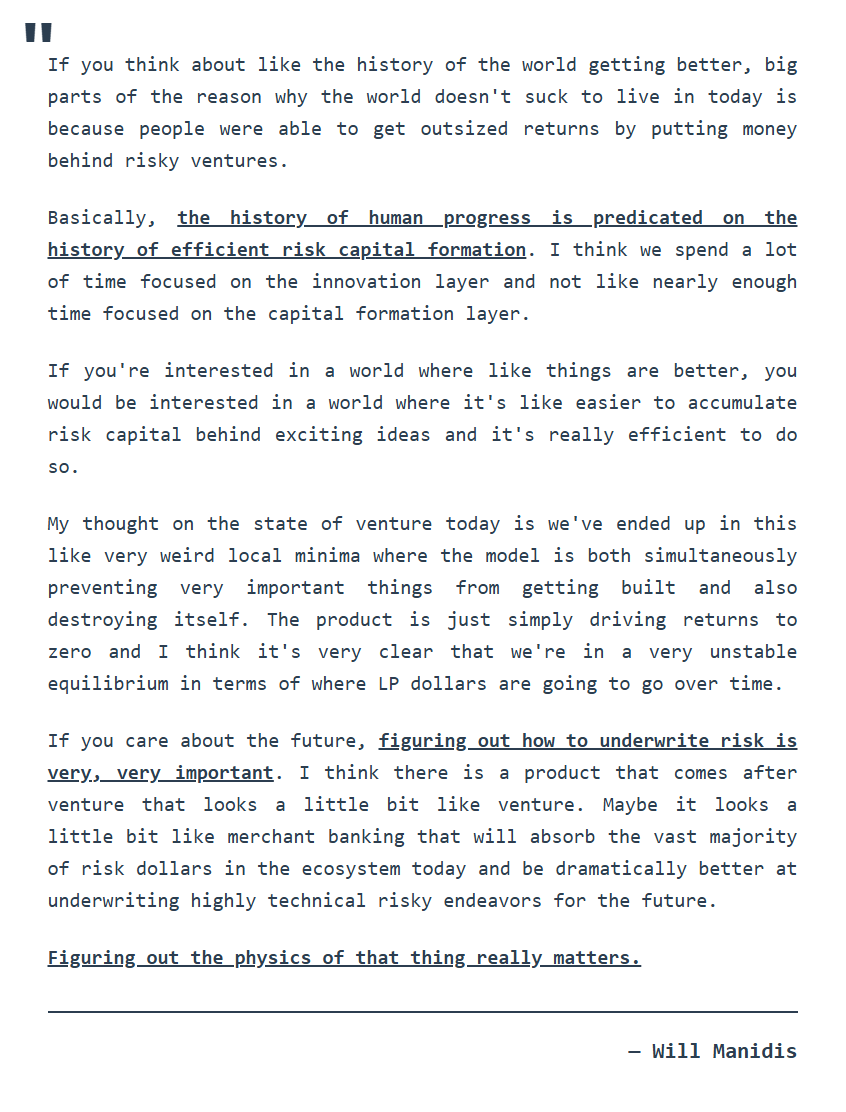

The quote below, from @WillManidis, is worth the consideration of every venture investor, GP and LP.

(It's also core to the mission of @equidam: making idiosyncratic ideas more legible for finance.)

As a product of incentives, capital in VC has gravity. It is inclined to collect in pools,... See more

We tend to index what has worked before. The future often rhymes but doesn’t repeat the past. Looking back on the past decade, one can observe how cloud and mobile have created massive companies and crowned multiple venture funds as beneficiaries. However, one needs to consider that these markets might have matured and are not as high-volatility... See more