Risk Capital - Credistick

- The muscles of portfolio construction and valuation atrophy, as consensus-driven ‘access’ dominates behavior and idiosyncratic risk falls out of favour.

- The typical ‘power law’ distribution of outputs collapses as few genuine outliers can be realised from a concentrated pattern of investment.

- As returns converge on a mediocre market-rate, investors

WIll Manidis • Risk Capital - Credistick

Despite mountains of theory and evidence supporting idiosyncratic risk as the source of outperformance, it’s just not where the incentives lie for venture capital.

Risk Capital - Credistick

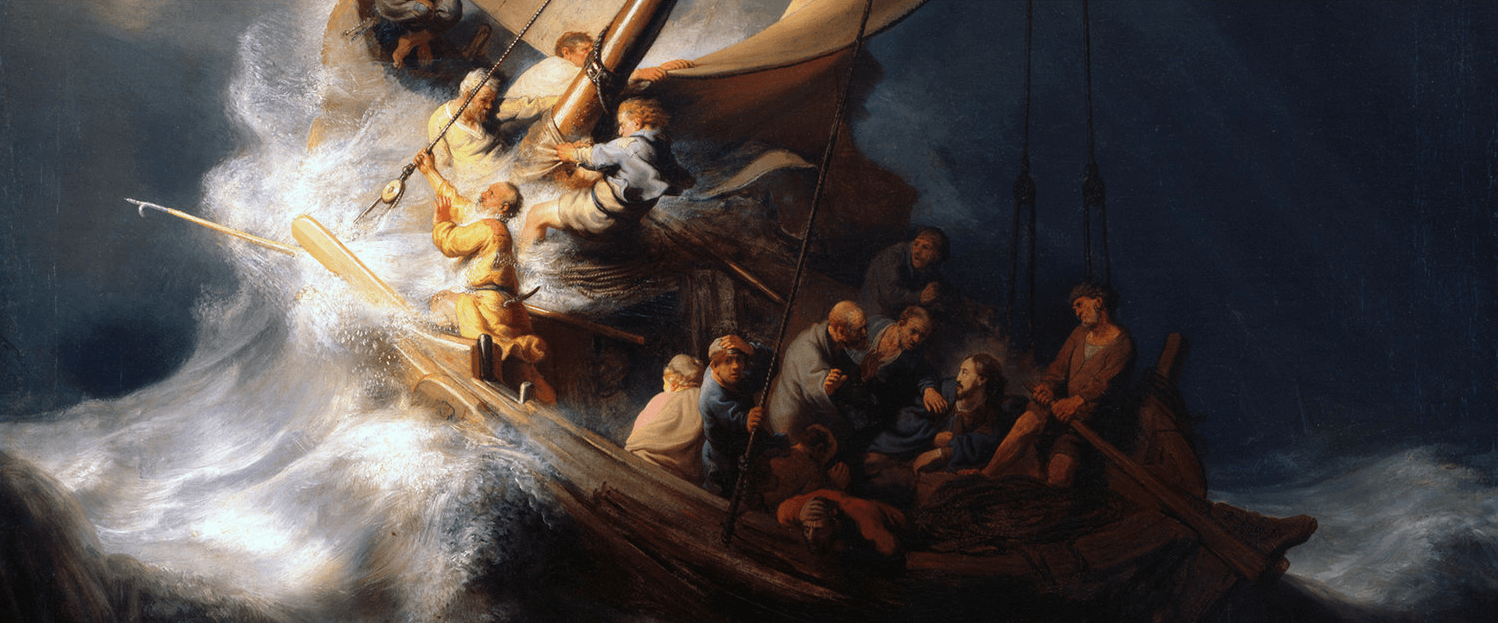

- aking systematic risk means following the crowd. It’s an easier story to sell LPs, and there’s less career risk if it goes wrong as accountability is spread across the industry.

- Taking idiosyncratic risk means wandering freely. It’s tough to spin into a coherent pitch, and there’s more obvious career risk associated with the judgement of those